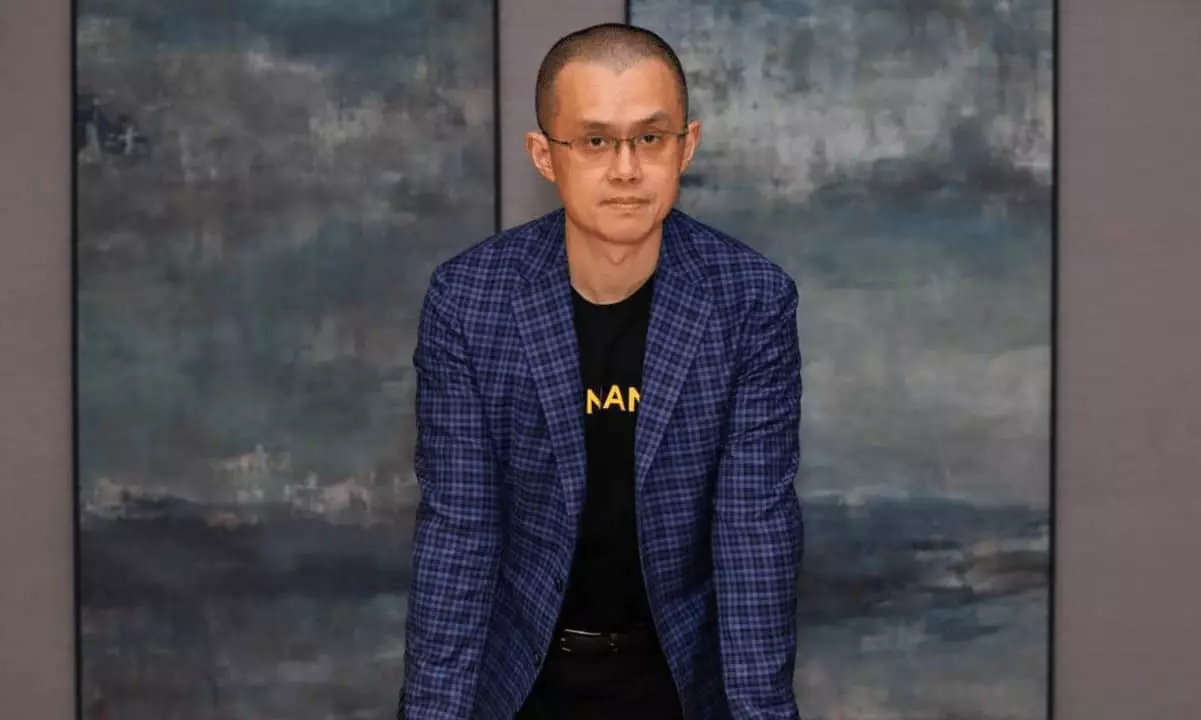

In an age where digital currencies shape the financial landscape, Changpeng Zhao (CZ), the founder of Binance, has struck a vital chord by pushing for the integration of a “will function” in cryptocurrency platforms. This suggestion isn’t merely a novel idea; it signifies a pressing necessity in an environment rife with uncertainty. As more individuals invest in cryptocurrencies, the sobering reality of life and its unpredictability brings to light the need for mechanisms that allow users to ensure their digital assets are responsibly handed down when they pass away. CZ’s proposal bears immense weight, as inadequate succession planning is a critical flaw that could affect countless families grappling with loss.

Cryptocurrency Inheritance: A Growing Crisis

The conversation surrounding inheritance in the crypto world was ignited by insights from cryptobraveHQ, revealing that over a staggering $1 billion worth of digital assets is lost annually to centralized exchanges due to unanticipated deaths. It’s a shocking statistic, one that underscores a failure not only on the part of crypto holders to communicate their investment strategies to their families but also on exchanges to provide a viable solution for asset transfer posthumously. The problem is compounded by the emotional turmoil families face when dealing with the loss of a loved one; the last thing they need is to navigate the complexities of unclaimed digital assets.

Advocating for Minors and Legitimate Access

Zhao’s advocacy extends beyond mere inheritance features; he suggests that regulators should allow minors to own crypto accounts that can receive payments but not trade. This groundbreaking perspective challenges longstanding financial conventions and emphasizes a progressive shift toward financial literacy and access. Allowing minors to inherit digital wealth provides them a foundation for future financial empowerment, inevitably paving the path for a generation more attuned to the value of cryptocurrency.

Binance’s Innovative Approach vs. Traditional Solutions

In response to the urgent calls for improved inheritance solutions, Binance has introduced an innovative “emergency contacts and inheritance heir” feature. This not only allows users to designate trusted individuals for their crypto holdings but also streamlined the inheritance process in a way that contrasts sharply with other platforms like Coinbase and BitGo. While Coinbase’s method remains tethered to conventional bureaucracy—requiring legal documents for heirs—the flexibility inherent to Binance’s system speaks volumes about its commitment to user-centered design and forward-thinking technology. The delay-rich, document-heavy processes are outdated and inadequately prepared for the fast-paced world of crypto.

Leading Through Transparent Reporting and Responsibility

Moreover, Binance’s monthly proof of reserves (POR) disclosures reinforce its commitment to transparency in a market that has often been mired in skepticism. As a platform that prioritizes user trust through accountability, Binance exemplifies the ethos that crypto platforms should adopt. In prioritizing not just their current users’ assets but also their future generations, they set a benchmark for what successful cryptocurrency operations should embody—responsibility and foresight.

Crypto is not just about immediate gains or speculative investments; it’s about long-term planning, sustainability, and legacy. The urgency of adapting to these modern financial realities cannot be overstated.