In the dynamic world of cryptocurrency, few assets capture attention quite like Ethereum. Having recently enjoyed a remarkable rally, the digital currency now finds itself at a critical juncture, bordered by volatility and optimism. Currently, buyers face a pivotal resistance level at $2,740, following a notable surge that saw Ethereum bounce back from a prolonged period of bearish sentiment. As the market shifts gears, it’s imperative to unpack the implications of Ethereum’s price movements, particularly focusing on the increasingly crucial support level around $2,400, which may serve as a litmus test for the cryptocurrency’s trajectory.

The Bullish Surge and Subsequent Pause

After months of grappling with overwhelming selling pressure, Ethereum has made an impressive comeback, rallying over 50% in just a week. This resurgence signals a much-anticipated turnaround for many traders. However, the current scenario presents a paradox. While one might expect continued bullish momentum following such a sharp rise, Ethereum’s new pricing ceiling at $2,740 introduces elements of uncertainty common in a market that can swing between rapid ascents and sharp corrections. Traders are left in a precarious position, caught between euphoria and fear as they contemplate the sustainability of this bullish trend.

Understanding the Technical Landscape

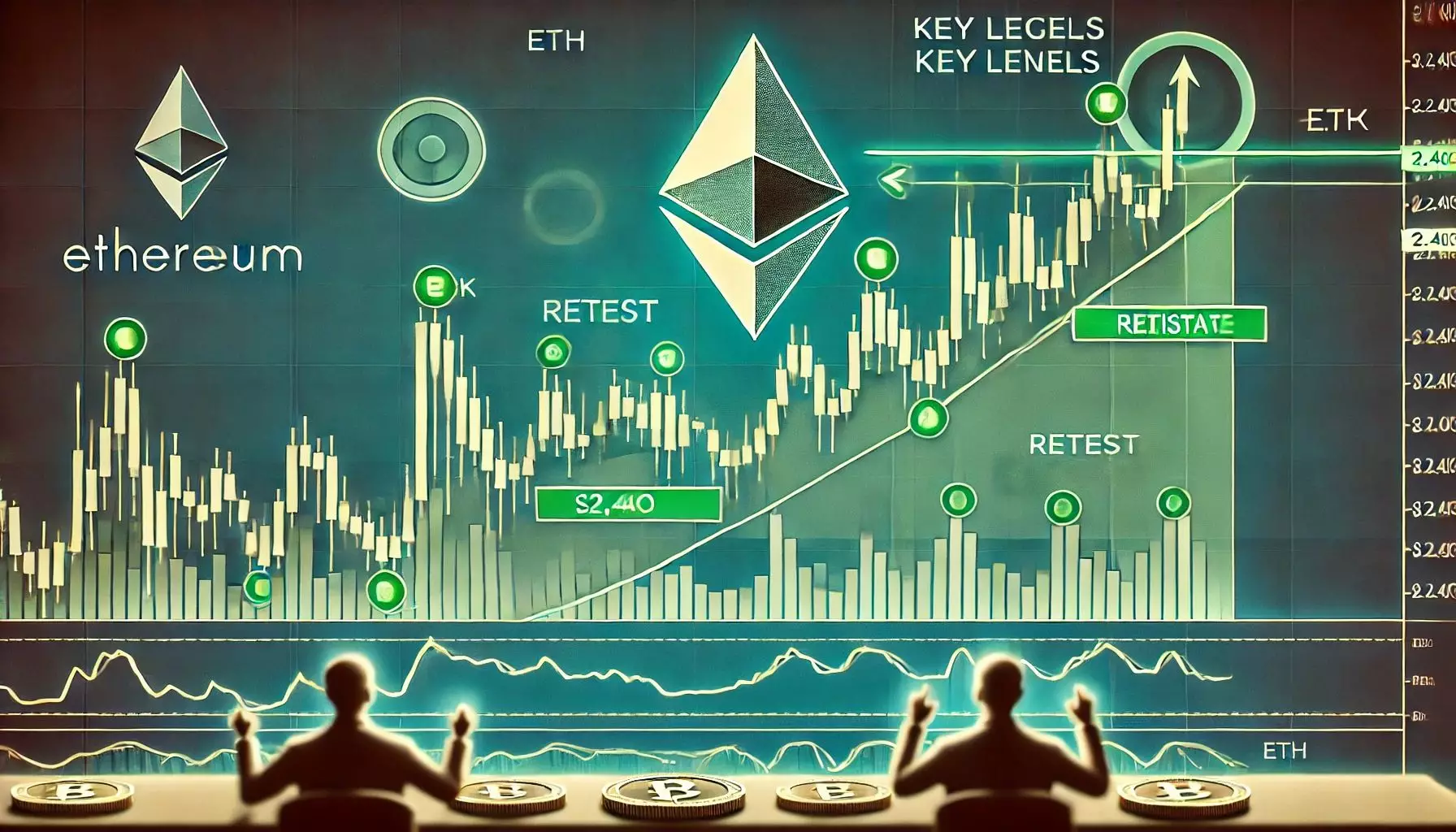

Top analysts, such as the noted trader Daan, highlight $2,400 as a critical support zone in the wake of Ethereum’s recent price action. Daan’s emphasis on this level underscores its importance in establishing a healthy trading structure. His warnings about the exceedingly high Open Interest in Ethereum’s derivatives market hint at the potential for a market correction if excessively leveraged positions face liquidation. This adds another layer of complexity, suggesting that a fleeting surge could lead to an equally swift downturn if traders aren’t cautious. These technical indicators serve as sobering reminders: the road to sustainable growth is fraught with peril.

Institutional Interest and Thereafter

The palpable excitement around Ethereum signifies growing institutional interest, as more organizations consider integrating this blockchain technology into their operations. This development amplifies the positive sentiment surrounding the asset, igniting hopes for an ‘altseason’—a term used to describe a period when altcoins surge in value. However, institutional players are not merely avid cheerleaders; they are dissecting the underlying movements with a discerning eye. For savvy investors, this period will require careful analysis of price action, resistance levels, and crucial support zones, rather than succumbing to the short-lived excitement of past rallies.

The Consolidation Phase: A Double-Edged Sword

While the prospect of consolidation may sound tedious, it can also be a favorable signal when approached correctly. Traders are often seduced by the allure of quick profits, yet the reality is that a well-defined period of consolidation can set the stage for a stronger bullish rally down the line. Daan’s analysis suggests a potential range forming between $2,400 and $2,700. If Ethereum can effectively utilize this phase to stabilize and form a bottom, it may not just prove that it has shaken off the shackles of longer-term downtrends—this could also serve as a springboard for further advancements towards the $3,000 mark.

Key Levels to Watch: More than Just Numbers

As Ethereum hovers between pivotal levels, it is crucial for traders to keep their eyes peeled for more than just simple price points. The significance of maintaining levels above the 200-day EMA and the importance of higher lows cannot be overstated; these metrics offer a foundational understanding of market momentum. If market forces can secure a bounce-back from the $2,400 level, the psychological and technical barriers may pave the way for a sustained rally. Conversely, slipping below this low could unravel investor confidence, posing a risk of a sharper decline toward the $2,200 threshold.

A Cautionary Tale of Blind Optimism

In the world of cryptocurrency, sentiment can shift in the blink of an eye. While the recent rally offers glimmers of hope, it is imperative for investors to exercise caution. The exuberance surrounding Ethereum’s price movements often masks underlying weaknesses and risks. The current phase calls for a healthy blend of enthusiasm and scrutiny, as traders are urged to remain vigilant against complacency. It serves as a stark reminder that the market can just as easily revert to pessimism as it can soar to new heights, reinforcing the notion that every bullish trend has an inherent risk component.

By maintaining focus on crucial support levels and remaining adaptive to changing market dynamics, Ethereum enthusiasts might successfully navigate these challenging waters. As the digital currency approaches the critical $2,400 benchmark, the ultimate question remains—will it be a launching pad for sustained growth, or a catalyst for renewed selling pressure? Only time will tell, but the implications are too significant to overlook.