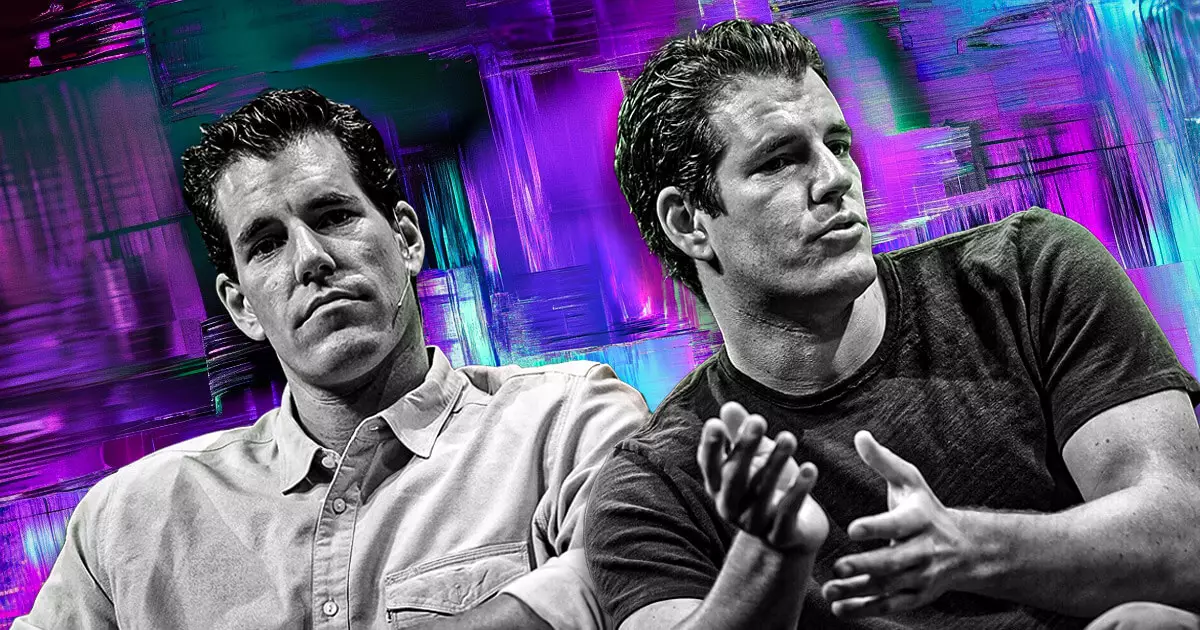

In a significant move shaking the foundations of the digital asset landscape, Gemini, the brainchild of the Winklevoss twins, has officially filed a draft registration statement with the SEC for an initial public offering (IPO). This should signal caution to skeptics, as it hints at a considerable shift in how traditional markets view cryptocurrencies. The timing is crucial; it occurs at a moment when sentiment around digital assets appears to be preparing for a favorable thaw, thanks in no small part to potential shifts in Washington’s policy that may usher in an era of acceptance and growth.

Market Readiness: The Perfect Storm

The ability for exchanges like Gemini to go public hinges on delicate market conditions and responsive regulation—both of which are currently in a precarious balance. While the SEC continues its review, market signals indicate an eagerness among investors to reinvest in stable, asset-backed platforms. High-performing IPOs in the crypto sector, such as Circle’s, which skyrocketed from an initial $31 to highs well over $100, provide credible evidence that a robust appetite exists for shares in digital asset firms. This willingness for investment coupled with Gemini’s development positions it as a pioneer potentially benefitting from a all-time high momentum—not something to be overlooked.

Implications for Competitors

The race is clearly on among various crypto entities eying the public markets. With Gemini now gearing up, other players like Kraken and their rumored IPO discussions with major investment banks like Goldman Sachs demonstrate a larger trend: not only is the appetite for IPOs growing, but competitors recognize the urgency in capitalizing on favorable market dynamics. The spirit of innovation prevails as the industry witnesses crypto companies skyrocket into the public eye, shattering preconceived notions regarding the merit of their business models. As these platforms generate revenue, traditional finance may have no choice but to adapt.

Cryptocurrency’s Unstoppable Ascent

James Seyffart, an analyst, underlines the importance of supportive political sentiment toward digital assets. A favorable administration can catalyze even more exchanges to venture into public markets—an opportunity that could redefine what it means to invest in blockchain technologies. The narrative is changing, and Gemini’s impending foray into the stock market underscores a collective belief that cryptocurrencies will soon be perceived not merely as speculative assets, but legitimate investments.

The Culture of Trust and Accountability

Embracing transparency through an IPO may allow Gemini to elevate its standing among its peers and investors alike. A public listing implies a level of accountability that the crypto sector desperately needs. Providing shareholders with insights into their operations can dispel lingering skepticism around the industry and attract mainstream investors. Ultimately, this move could mature the crypto market, establishing trust amongst stakeholders who have long viewed it with distrust.

As Gemini cautiously steps toward its IPO, it is essential to appreciate this not just as a moment of individual triumph but as a potential inflection point for the wider cryptocurrency ecosystem. The optimism behind such movements signals a growing recognition of cryptocurrency as a respectable force in the financial domain, beckoning a new era filled with promise and unprecedented growth.