The collapse of the cryptocurrency exchange FTX has had far-reaching impacts on the financial landscape and the individuals involved. Once a titan in the cryptocurrency realm, FTX was celebrated for its ambitious advertising campaigns and unprecedented growth. However, its meteoric rise crumbled due to allegations of fraud, mismanagement, and unethical practices led by its founder, Sam Bankman-Fried (SBF). This implosion not only tarnished the company’s reputation but also prompted extensive legal actions against its key players, including Caroline Ellison, the former CEO of Alameda Research.

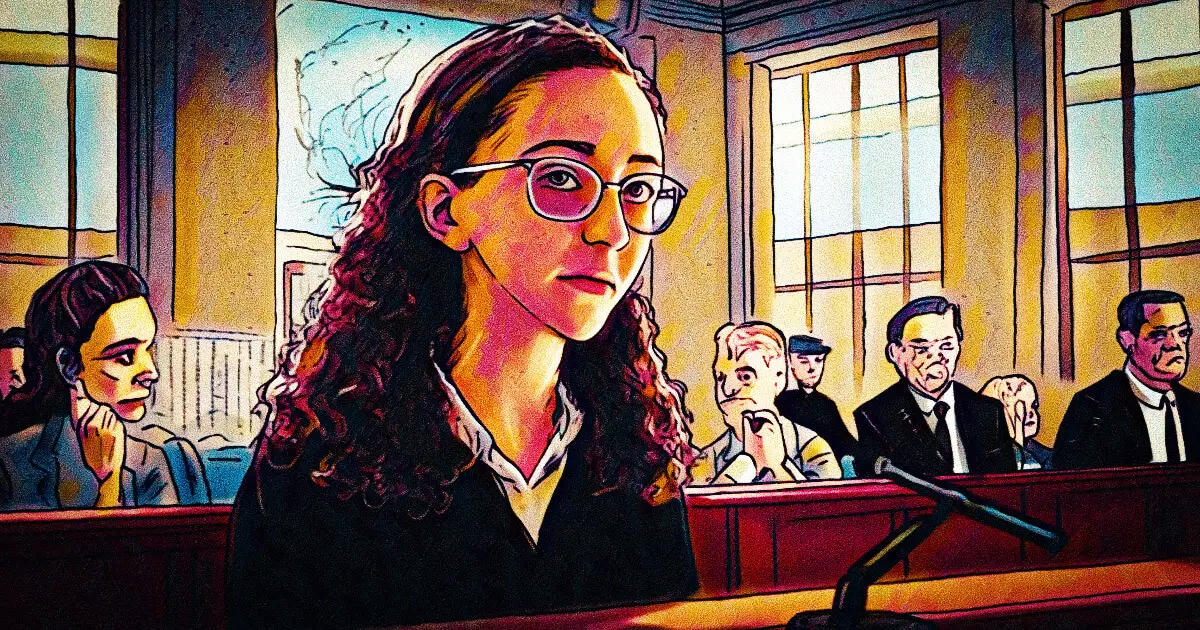

Recently, Ellison was sentenced to two years in prison, along with an order to forfeit $11 billion for her involvement in the downfall of FTX. Despite her requests for leniency, citing her cooperation with federal prosecutors as pivotal in convicting SBF, the court upheld a sentence that reflects the gravity of her actions. Ellison’s legal counsel argued for a reduced sentence, highlighting her significant contributions during the investigation. They pointed to her journey back from the Bahamas and her substantial role in unearthing the financial irregularities that plagued both FTX and Alameda Research.

However, her defense also painted a picture of Ellison as a product of her environment—a victim of SBF’s manipulative strategies that clouded her moral judgment. While these arguments aim to evoke sympathy, the court ultimately prioritized accountability over circumstances, marking a crucial stance in the broader pursuit of justice in the crypto world.

Ellison’s testimony during SBF’s trial was instrumental in shaping the outcome, acknowledged even by SBF’s defense as a critical factor in securing a conviction. Her revelations during the three-day testimony not only exposed the operations at FTX but also painted an unsettling picture of systemic corruption and negligence among its senior executives. The prosecutors labeled her contributions as the “cornerstone” of their case, which led to a guilty verdict on multiple fraud charges against SBF.

This situation raises important questions about the accountability of corporate leaders and the ethical obligations that come with managing massive financial institutions. The notion of cooperation as a mitigating factor in sentencing is contentious; it begs the question of whether the legal system should offer leniency to individuals who potentially participated in—or enabled—fraudulent activities.

The repercussions of the FTX fallout extend beyond individual sentences. The case has acted as a grim reminder of the necessary regulatory scrutiny needed in the cryptocurrency sector, which has often operated in a nebulous legal environment. The dramatic rise and fall of FTX has highlighted the vulnerabilities in this rapidly evolving industry, bringing attention to the ethical dimensions of cryptocurrency trading and the need for robust consumer protections.

Furthermore, the sentence handed to Ellison is part of a larger wave of legal consequences faced by former FTX executives. With other key individuals awaiting sentencing, the guilty verdicts serve as a warning to others in the industry about the importance of ethical governance and transparency. As the crypto market continues to evolve, lessons drawn from the downfall of FTX will likely shape the future regulatory landscape, striving to prevent a repeat of such catastrophic failures.