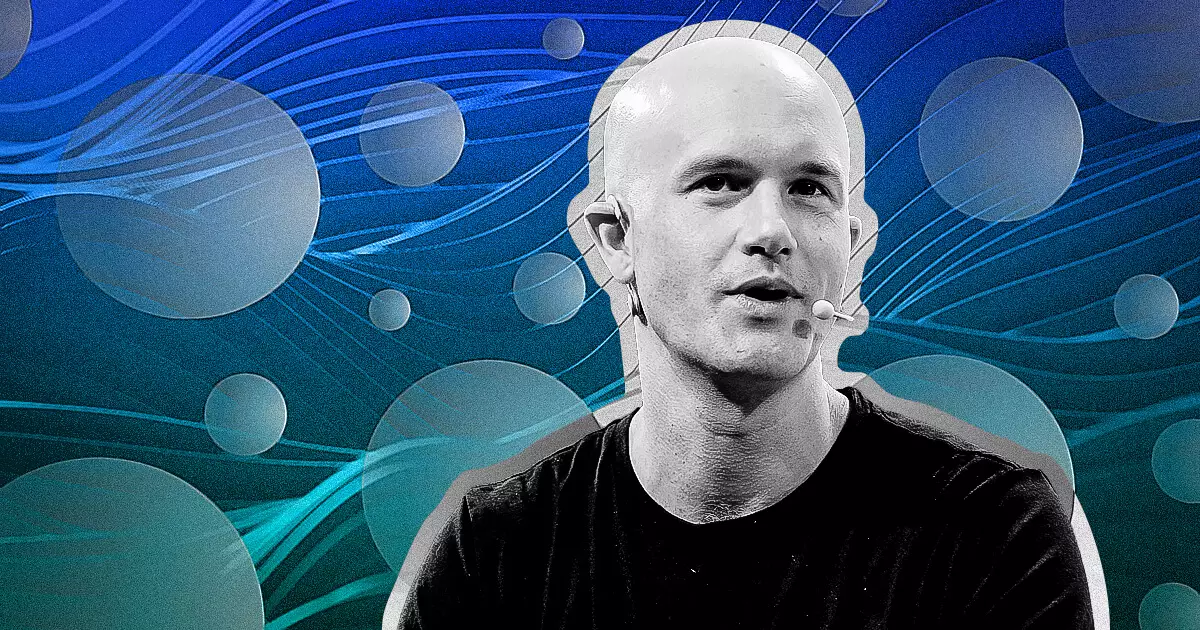

In recent years, the cryptocurrency landscape has witnessed unprecedented growth, driven by technological advancements and a surge in new financial instruments. This explosive growth has brought with it significant challenges, particularly in the ways tokens are listed and evaluated on exchanges. Brian Armstrong, CEO of Coinbase, articulated these concerns in a social media post, highlighting the discrepancies between traditional asset assessment methods and the rapid proliferation of digital tokens. His insights emphasize an urgent need for an innovative approach to token listings that accommodates the contemporary pace of the crypto industry.

The current token listing system, characterized by stringent centralized approval processes, is becoming increasingly untenable as an estimated one million new tokens emerge weekly. The reliance on manual evaluation systems raises significant concerns about efficiency and scalability. Traditional evaluation methods simply cannot keep up with the speed and volume of new asset creation, leading to a bottleneck that could stifle innovation in an industry poised to revolutionize financial systems.

Armstrong’s remarks reveal a fundamental flaw in existing protocols—namely, that the framework does not adequately address the diverse and evolving nature of digital assets. The influx of no-code solutions and token generators has democratized access to cryptocurrency creation, resulting in an overwhelmingly diverse asset landscape that current systems are ill-equipped to navigate.

In light of these challenges, Armstrong proposed a transformative shift towards a block-list model. This innovative system would operate under the premise that tokens are accessible by default, and only flagged as harmful if identified through robust user feedback and automated data monitoring. This approach not only alleviates the burden on centralized authorities but also empowers users, allowing them to take a more active role in determining the safety and viability of tokens.

Such a paradigm shift would harness the power of community engagement and technological capabilities, allowing for continuous adaptation and responsiveness to emerging threats. The block-list model represents a forward-thinking strategy that aligns with the decentralized ethos of blockchain technology while enhancing user confidence in digital asset investments.

Accompanying this industry evolution is the pressing need for regulatory frameworks that can keep pace with technological advancements. Armstrong emphasized that existing regulatory mechanisms are largely outdated and insufficient for the current crypto landscape. The call for regulatory innovation is crucial—regulators must engage with industry leaders to create adaptive frameworks that ensure investor protection without hindering innovation.

The relationship between regulatory bodies and the cryptocurrency industry is a two-way street. As Armstrong pointed out, both sectors must collaborate to develop standards that safeguard consumer interests while fostering an environment ripe for innovation. This collaborative approach would not only protect investors but also encourage responsible growth within the market.

Beyond token listing discussions, Armstrong reaffirmed Coinbase’s commitment to integrating decentralized exchange (DEX) functionality into their platform. This strategic move aims to streamline access to both centralized and decentralized trading options, allowing users to engage seamlessly with the burgeoning blockchain ecosystem.

The ability to navigate both CEX and DEX environments without needing to delineate between them represents a significant step toward user-centric trading experiences. As one of the largest crypto exchanges globally, Coinbase’s initiatives could set a benchmark for the industry, further entrenching decentralized finance (DeFi) principles into mainstream usage.

Armstrong’s comments highlight a broader commitment from Coinbase to transparency, security, and user empowerment in a rapidly evolving blockchain landscape. The urgency for an overhaul in token listing processes reflects not only the challenges of the present but also the limitless possibilities of the future. Through innovative models and collaborative regulatory efforts, the cryptocurrency industry can navigate its path forward, ensuring sustainable growth that benefits all stakeholders involved. The call for change is clear: adapt, innovate, and empower—these are the keys to thriving in the dynamic world of digital assets.