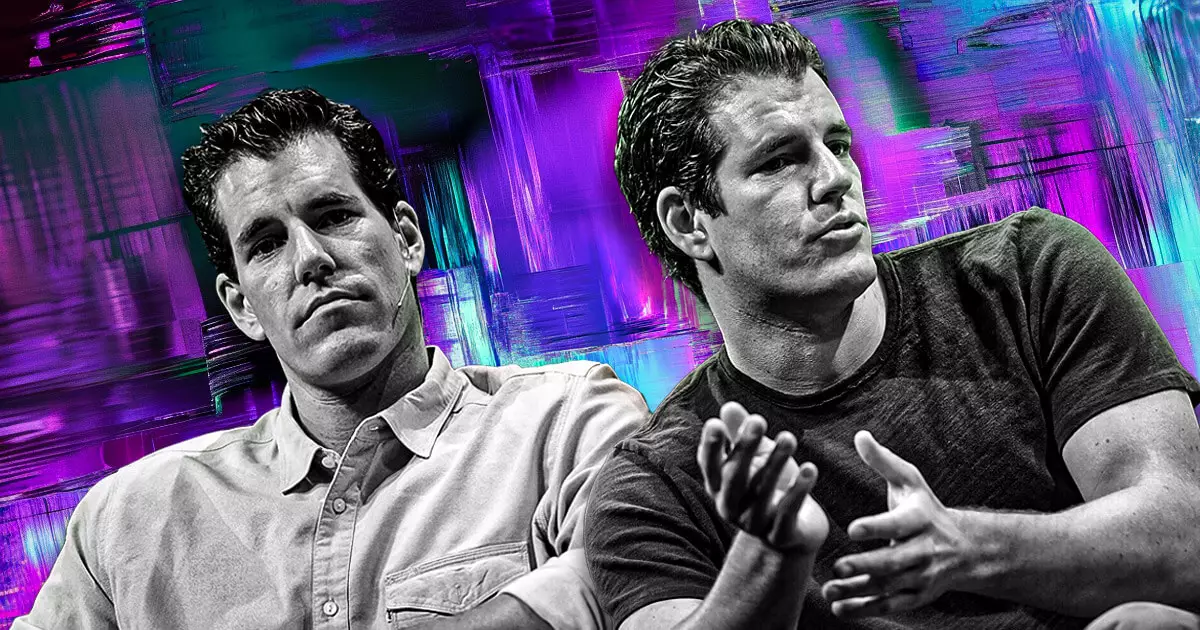

In a significant and unexpected move, Gemini, one of the largest cryptocurrency exchanges in the United States, has declared a hiring freeze on Massachusetts Institute of Technology (MIT) graduates and interns. This decision stems from the university’s recent association with Gary Gensler, the former Chair of the U.S. Securities and Exchange Commission (SEC). Tyler Winklevoss, co-founder of Gemini, took to social media platform X to announce this unprecedented action, stating unequivocally, “As long as MIT has any association with Gary Gensler, Gemini will not hire any graduates from this school. Not even interns for our summer intern program.” This bold declaration underscores the growing tensions between the cryptocurrency industry and financial regulatory bodies.

Recent developments at MIT saw Gensler being welcomed back as a Professor of Practice at the Sloan School of Management. His focus areas, including artificial intelligence, finance, fintech, and public policy, are undeniably significant, but his controversial history at the SEC casts a long shadow over this appointment. During his tenure, Gensler was known for implementing strict regulations that many in the crypto community argue stifled innovation rather than fostering it. Critics have not held back, labeling his hiring as a serious misstep by MIT. Cameron Winklevoss, Tyler’s twin brother and co-founder of Gemini, voiced strong opposition, labeling Gensler “the world’s leading expert on public policy failures.”

Gemini’s decision is emblematic of a wider dissatisfaction in the cryptocurrency arena concerning how regulatory frameworks are shaping the industry. As cryptocurrency evolves, many industry leaders feel that regulators, particularly figures like Gensler, are standing in the way of healthy innovation. Prominent figure Matt Huang, co-founder of Paradigm, has urged MIT-affiliated professionals in the crypto space to consider similar actions, hinting at potential collective responses to Gensler’s return that could extend beyond the hiring policies of one company.

Additionally, Caitlin Long, CEO of Custodia Bank, raised a thought-provoking question regarding the broader implications of Gensler’s return to MIT. She wondered if this could lead to a significant shift in how companies engage with educational institutions that welcome individuals such as Gensler—government officials viewed by many as having enacted policies hostile to the crypto industry. Long noted, “The world has changed—the crypto industry has already urged boycotting law firms that hired revolving-door ex-govt regulators that attacked the law-abiding industry.”

The unfolding scenario between Gemini and MIT signals a pivotal moment for the cryptocurrency industry. It reflects a growing trend among industry players to actively oppose regulatory figures that they perceive as obstacles to their growth and innovation. As the crypto community grapples with the implications of Gensler’s association with MIT, the tension between traditional financial regulations and the burgeoning field of cryptocurrency continues to intensify. The question looms large: will more companies join Gemini in distancing themselves from academic institutions that engage with those who advocate for restrictive policies, or will the industry seek a more conciliatory approach? The answers will likely shape the future of cryptocurrency development and regulation.