Bitcoin, the leading cryptocurrency, has recently captured the attention of investors and analysts alike, particularly during the tumultuous months of December and January. Surpassing the critical $100,000 benchmark, Bitcoin reached unprecedented heights before entering a phase of notable instability, oscillating drastically within a tight range between $92,000 and $106,000. This marked a 75-day period characterized by sideways trading, which recently culminated in a significant downturn that saw Bitcoin plummet below $80,000. Such volatility raises questions about the sustainability of Bitcoin’s upward trajectory and the factors contributing to its rapid fluctuations.

This dramatic decline is not an isolated event for Bitcoin but rather reflects broader economic trends currently pervading global markets. With an administration in the U.S. increasingly focused on economic reforms, investors seem to be experiencing a collective retreat, as evidenced by a 3.5% decline in the NASDAQ Composite and a 2.92% drop in gold futures. Furthermore, the U.S. economy recently reported its first decline in consumer spending over a two-year stretch, underscoring a potential shift in consumer confidence and economic stability. Such macroeconomic pressures have engendered a “Trump dump” effect, where many asset classes, including cryptocurrencies, are feeling the weight of generalized pessimism.

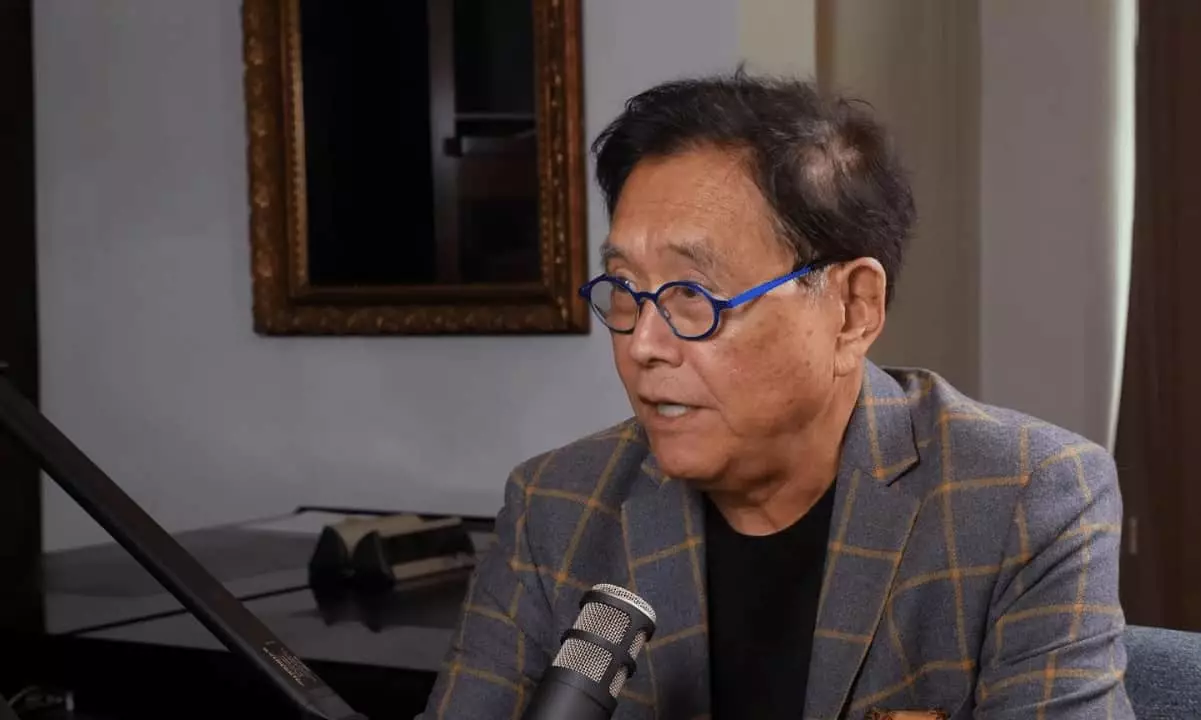

While Bitcoin experiences these fluctuations, it’s telling that even its largest investors—commonly referred to as ‘whales’—are beginning to offload significant amounts of the cryptocurrency. This behavior can often signal a larger trend of selling pressure, which complicates the market landscape further. Yet, amid this turmoil, some industry experts, including Robert Kiyosaki, maintain a bullish outlook on Bitcoin, asserting that its value is fundamentally strong and providing a counter-narrative to the prevailing market sentiment.

Prominent figures in the market, such as BitMEX founder Arthur Hayes, anticipate another potential downturn before the market establishes a more solid foundation free of sellers. Their predictions are proving somewhat prescient, as a corrective wave recently saw Bitcoin stabilize after approaching support levels near $78,200, before rebounding to over $86,000. Such swift recovery indicates a robust interest from buyers—evidenced by heightened trading volumes and increased social media activity around the phrase “buy the dip.” These factors collectively suggest that while price corrections are painful, they also create fertile ground for new investment.

Kiyosaki’s perspective sheds light on a deeper crisis, criticizing the U.S. monetary system rather than Bitcoin itself. His assertion that Bitcoin represents “money with integrity” emphasizes a growing realization among investors that traditional financial systems may not yield the long-term security they once did. As the national debt climbs to $36 trillion alongside staggering unfunded obligations, it’s clear that calls for reform are echoed not just in the halls of government but also in the crypto space.

In summation, the Bitcoin market stands at a pivotal junction characterized by volatility, macroeconomic pressures, and an unwavering belief in future recovery. As investors navigate these turbulent waters, the underlying discourse surrounding Bitcoin’s potential as an alternative monetary system continues to grow, inviting further scrutiny and engagement within the financial community.