Ethereum is standing at a pivotal juncture, grappling with both technical barriers and global economic uncertainty. As it trades near $1,610, this well-known cryptocurrency finds itself ensnared in a tight price band, oscillating between $1,550 and $1,630 for almost a week. This stagnation is anything but inconsequential. It mirrors the broader investor sentiment that has been riddled with hesitation and may serve as a precursor to either an explosive upward movement or a steep decline. The lack of significant volatility indicates widespread uncertainty, fueled primarily by escalating trade tensions between the United States and China. As an advocate for economic stability, one must view these developments critically.

Macro Forces Impacting Cryptocurrency Values

The geopolitical scenario is pronounced, as recent announcements from the U.S. government reveal a temporary halt on tariffs for all nations—except China. This decision has heightened fears of an extended trade conflict that could destabilize global financial markets, including the cryptocurrency sector. For center-right liberals like myself, the ramifications of such economic strategies are troubling. Rational economic policies encourage productive international partnerships rather than confrontation, which could lead to long-term instability. Therefore, the dichotomy of cryptocurrencies like Ethereum gaining relevance in a world of crumbling trust between nations adds a complex layer to the investment landscape.

Historical Signals Suggest Potential Accumulation Points

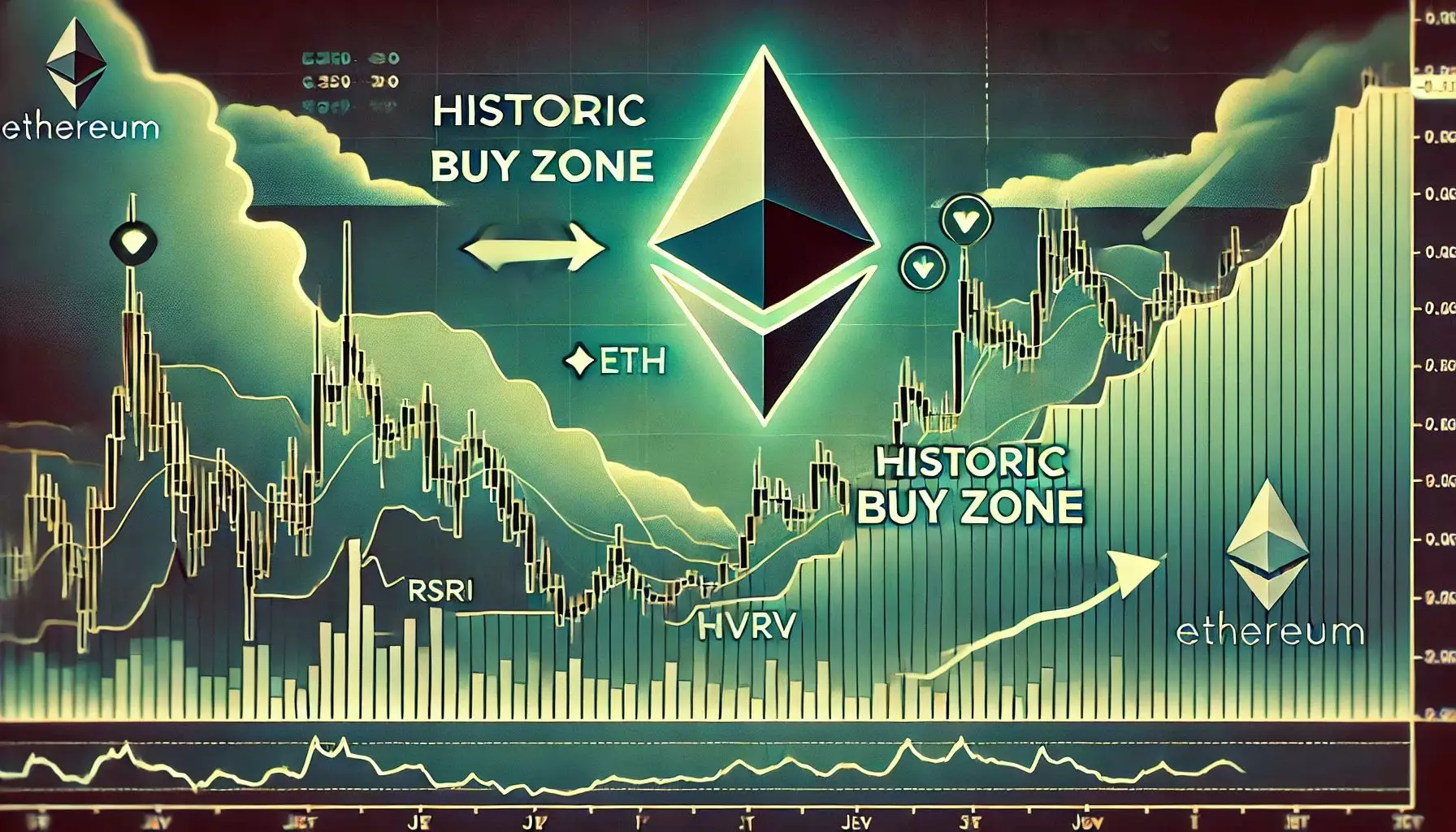

Despite prevailing uncertainty, analysts suggest that Ethereum might be tunneling toward a significant accumulation zone. A notable point raised by crypto analyst Ali Martinez indicates that historically low prices, especially those dipping below the lower bounds of the Market Value to Realized Value (MVRV) Price Band, have often signaled prime buying opportunities. Presently, Ethereum finds itself at this lower-bound position, lending credence to the idea that current market conditions could offer a rare chance for long-term investors to accumulate at discounted levels. One must engage with this perspective because it suggests a resilience in the asset class even amidst economic turmoil.

The Psychological Barriers Ahead

For Ethereum to break free from its current constraints, it needs to conquer significant psychological barriers. The $1,700 and $2,000 thresholds are not merely numbers; they symbolize crucial support levels that the market has previously tested and failed to maintain. When an asset hovers around such critical levels, it becomes a battleground for bulls and bears. The mere act of reclaiming the $2,000 mark could act as a catalyst for renewed buying interest, suggesting to investors that recovery is indeed possible. However, the potential for failure looms in this tight trading environment. Should the $1,550 mark give way under bearish pressure, the prospect of further declines looms large, bringing the $1,500 support zone into play.

Investment Psychology: Long-Term vs. Short-Term Traders

As speculative trading continues, the psychological impact on investors must not be overlooked. Short-term traders often create a ripple effect of volatility, responding quickly to news and price fluctuations. This dynamic contrasts sharply with the strategies of long-term investors, who may see current conditions as an opportunity for accumulation rather than a time to flee. The ongoing uncertainty in the macroeconomic landscape makes it particularly crucial for long-term investors to keep their focus amid the noise. It’s a nuanced discussion that requires a balanced viewpoint; while short-term traders may face emotional stress, those with a long-term mindset could end up gaining significant benefits once the market stabilizes.

Future Predictions: The Path Ahead for Ethereum

As we look toward the future, it’s essential to consider what might lie ahead for Ethereum. The dichotomy of extreme pessimism versus potential upside could shape the crypto market in the coming days. While the short-term scenario remains fluid and indicates consolidation, the long-term outlook suggests that Ethereum could be on the precipice of a significant turnaround—if it manages to escape its current tight trading range. Should analysts’ predictions hold true, and if market sentiment shifts toward optimism, the conditions could set the stage for a robust recovery.

Investors must prepare for this battleground with strategic foresight, as the prize isn’t merely financial gain; it’s the validation of cryptocurrencies as meaningful economic entities in an increasingly complex world. The resilience shown during these turbulent times might not only solidify Ethereum’s standing but could also reflect a fundamental shift in how we comprehend value in the digital age.