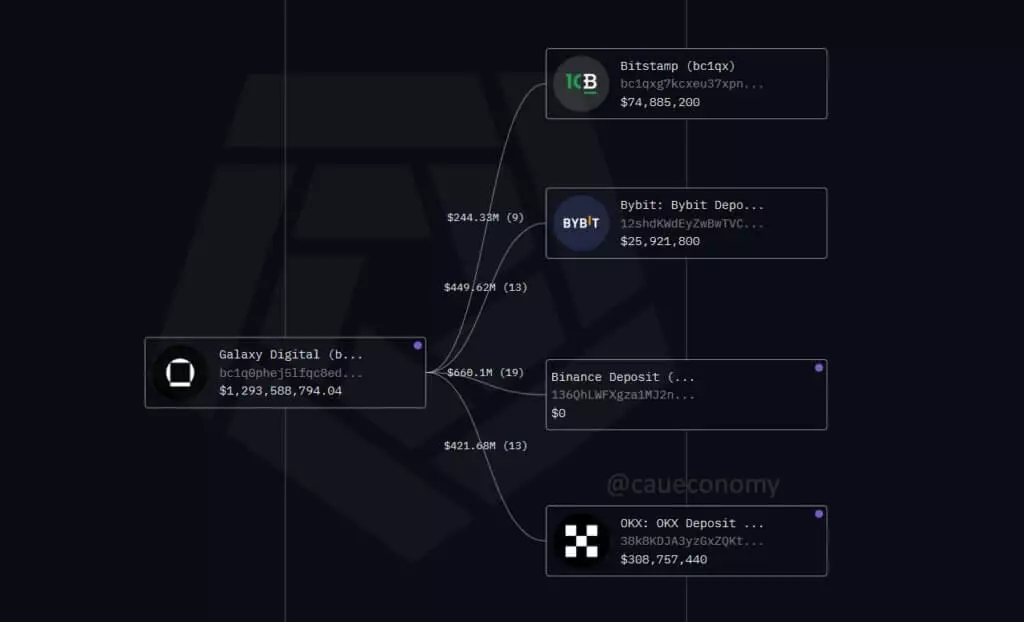

In a striking display of on-chain activity, Galaxy Digital’s recent Bitcoin movements reveal a brewing storm that could reshape the landscape of institutional crypto behavior. Over a 24-hour window, the firm relocated more than 17,000 BTC—valued at over $1.7 billion—primarily to leading exchanges such as Binance, OKX, Bybit, and Bitstamp. This isn’t just a routine transfer; it hints at a strategic shift by a major player with substantial holdings. The massive deposit of 80,000 BTC, accumulated from dormant wallets dating back to 2011, points to a deliberate consolidation, followed by an equally deliberate dispersal. Yet, what’s more telling is that the flow seems to be oriented toward distribution rather than reinvestment into long-term custody. The pattern of staggered dispersals to exchange hot wallets suggests a move to liquidate positions rather than engage in new accumulation—a cautionary sign for bullish sentiment.

Market Implications and Sentiment Analysis

The market’s reaction to these large-scale outs flows has been noticeable. Bitcoin’s value has dipped roughly 2.5% in response to concerns over increased sell-side pressure. With daily trading volumes ringing in at above $94 billion, traders are clearly reacting to the unfolding distribution, which on-chain data suggests could be the prelude to a more sustained downturn. The sharp decrease in Bitcoin’s price, coinciding with the diverting of substantial holdings towards exchanges, underscores an emerging narrative: institutional actors may be positioning themselves to capitalize on current volatility or mitigate potential losses. While Galaxy Digital’s remaining stash exceeds 60,000 BTC, the ongoing transfers raise questions about whether they intend to further de-risk or are preparing for a more significant sell-off.

The Underlying Strategic Unwind

An ominous note in this saga is the pattern behind the transfers. The dormant wallets—some active since before 2012—have suddenly awakened, dispersing large chunks of Bitcoin. Such activity suggests a calculated unwind rather than opportunistic selling. Analysts like Cauê Oliveira interpret this as an indication of a strategic move to lock in gains or prevent further downside risk. The net asset flow from institutional wallets, combined with minimal liquidity in the order books, hints at a market vulnerable to sharper declines if more players follow suit. The fact that major transactions have remained unconfirmed about their ultimate beneficiaries fuels speculation that a large institutional exit is underway, potentially foreshadowing a bearish shift that could impact retail sentiment and broader market stability.

Why This Matters for Broader Market Dynamics

This recent activity should serve as a wake-up call rather than a moment of complacency. Institutional moves like these have long been a barometer for the market’s health: when big players begin to offload, often with increased urgency, it can presage a broader correction. The combination of extensive on-chain transfers, declining prices, and reduced liquidity suggests that the bulls may be confronting a challenging period ahead. Far from being a routine rebalancing, these transfers represent a calculated defensive move in a fragile market environment. Investors should remain wary, recognizing that the concentration of Bitcoin among large institutions often amplifies market swings and can signal shifts in the overall trend. The question isn’t whether the trend will continue but how authorities, traders, and retail investors will adapt to these subtle yet impactful cues signaling that a more pronounced correction might be imminent.