The recent MegaETH token sale highlights an unsettling trend in the cryptocurrency landscape: the obsession with hype-driven projects that often lack real utility. While developers and promoters trumpet massive airdrops and exchange listings to excite retail investors, such maneuvers often mask underlying vulnerabilities. The increasing tendency for projects to leverage flashy marketing tactics over substantive technological advancement raises questions about the true maturity of the crypto ecosystem. This perpetual cycle of short-term gains fuels a speculative frenzy that can ultimately destabilize market confidence, echoing the excesses that plagued traditional financial bubbles earlier in history.

Questionable Use of Market Mechanics and the Power of Hype

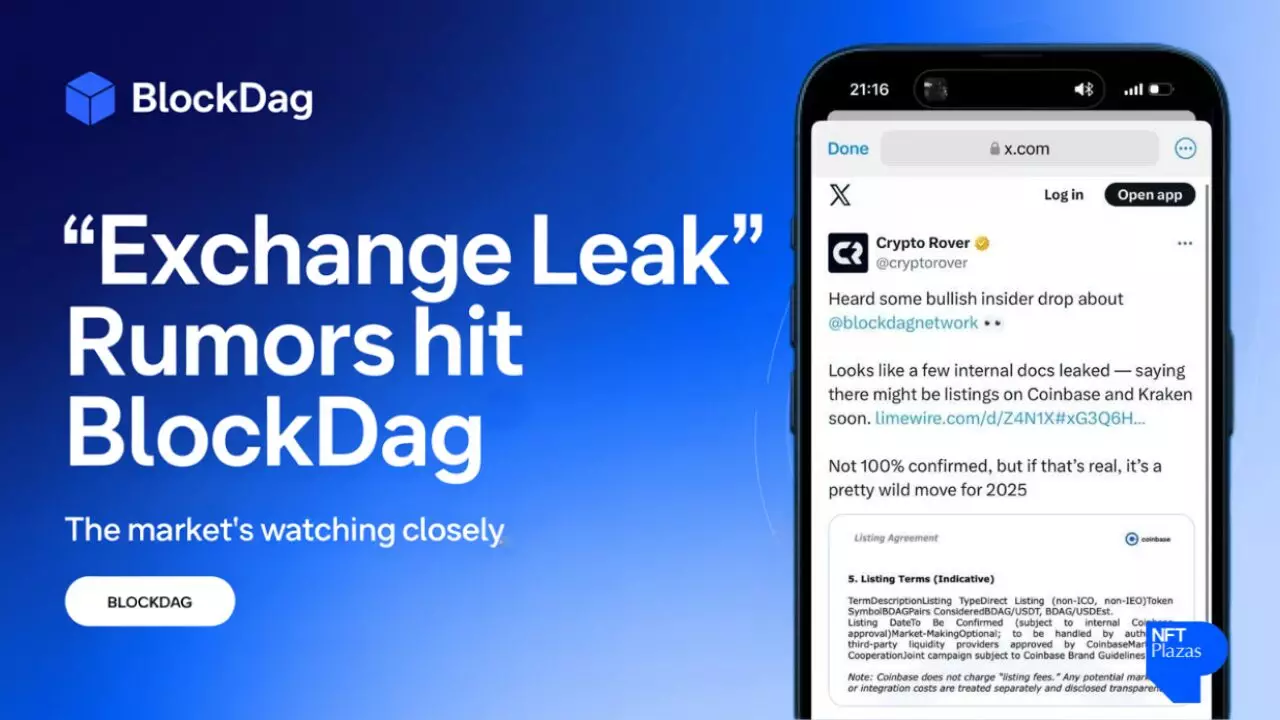

The strategic deployment of airdrops and exchange listings, especially on dominant platforms like Binance, suggests a calculated effort to manipulate perceived value. Rather than driven purely by technological innovation or long-term utility, these moves are increasingly used as tools to artificially inflate token prices. The recent listing of tokens like Giggle Fund (GIGGLE) and SynFutures (F) exemplifies this pattern. Retail investors are often encouraged to buy into the hype, unaware that such listings can be manipulated or prematurely overhyped, leaving latecomers vulnerable to sharp corrections. It’s a classic case of market psychology being exploited to sustain a fragile power structure that benefits insiders more than everyday investors.

Market Speculation and the Illusion of Sustainability

Beyond token sales and listings, the broader crypto narrative hinges on speculative bets about decentralization and technological disruption. Yet, many projects, such as the highly volatile KDA coins, serve more as vehicles for quick profit rather than sustainable innovation. The recent plunge of KDA over 60%, following a shutdown announcement, underscores the perilous nature of these investments, often driven by hollow promises rather than solid business models. This volatility feeds into a narrative that the market is inherently unstable, and perhaps intentionally so. A system built around such unstable assets cannot be considered resilient or mature; it is merely an elaborate gamble.

The Myth of Regulatory Sanctuary and the Looming Risks

Despite ongoing assurances from regulators and policymakers, the crypto industry remains precariously unregulated. The recent Federal Reserve policies hint at future rate adjustments that could dampen liquidity, exacerbating the bubble-like conditions. Meanwhile, institutions like Citi Bank project that stablecoins could balloon to $3.7 trillion by 2030 — a figure that is as alarming as it is unsustainable. Reliance on stablecoins for such scales presumes perpetual confidence in their backing mechanisms, but history shows that centralization and lack of transparency often lead to crises. This fuels a false sense of security that supports the bubble, making the entire system vulnerable to sudden collapses when confidence wanes.

The Illusory Promise of Decentralized Finance

The proliferation of DeFi projects such as Meteora, Monad, and Morphos demonstrates the blockchain community’s desire for revolutionary change. However, many of these endeavors are still grappling with fundamental issues like security, scalability, and genuine decentralization — often touted but rarely achieved. As these projects chase new infrastructure solutions or layer-one capabilities, they risk overpromising and underdelivering, further blurring the line between innovation and hype. The recent surge in token valuations, coupled with hype-driven narratives, suggests that the industry remains fundamentally susceptible to speculative mania, threatening to undermine the very ideals of decentralization and financial sovereignty that initially inspired the movement.

A Cautionary Reflection

The hype surrounding MegaETH and related initiatives reveals a broader systemic weakness rooted in speculation and superficial innovation. If the industry continues to prioritize short-term gains over sustainable development, it risks paving the way for an inevitable correction — or worse, a collapse. A more prudent, center-right approach would emphasize transparency, real-world utility, and cautious regulation, ensuring that crypto assets serve as tools for genuine progress rather than speculative schemes. Until then, investors and observers alike should remain deeply skeptical of the current cycle’s promised innovations, recognizing it as a fragile façade hiding deeper fragility within this nascent financial frontier.