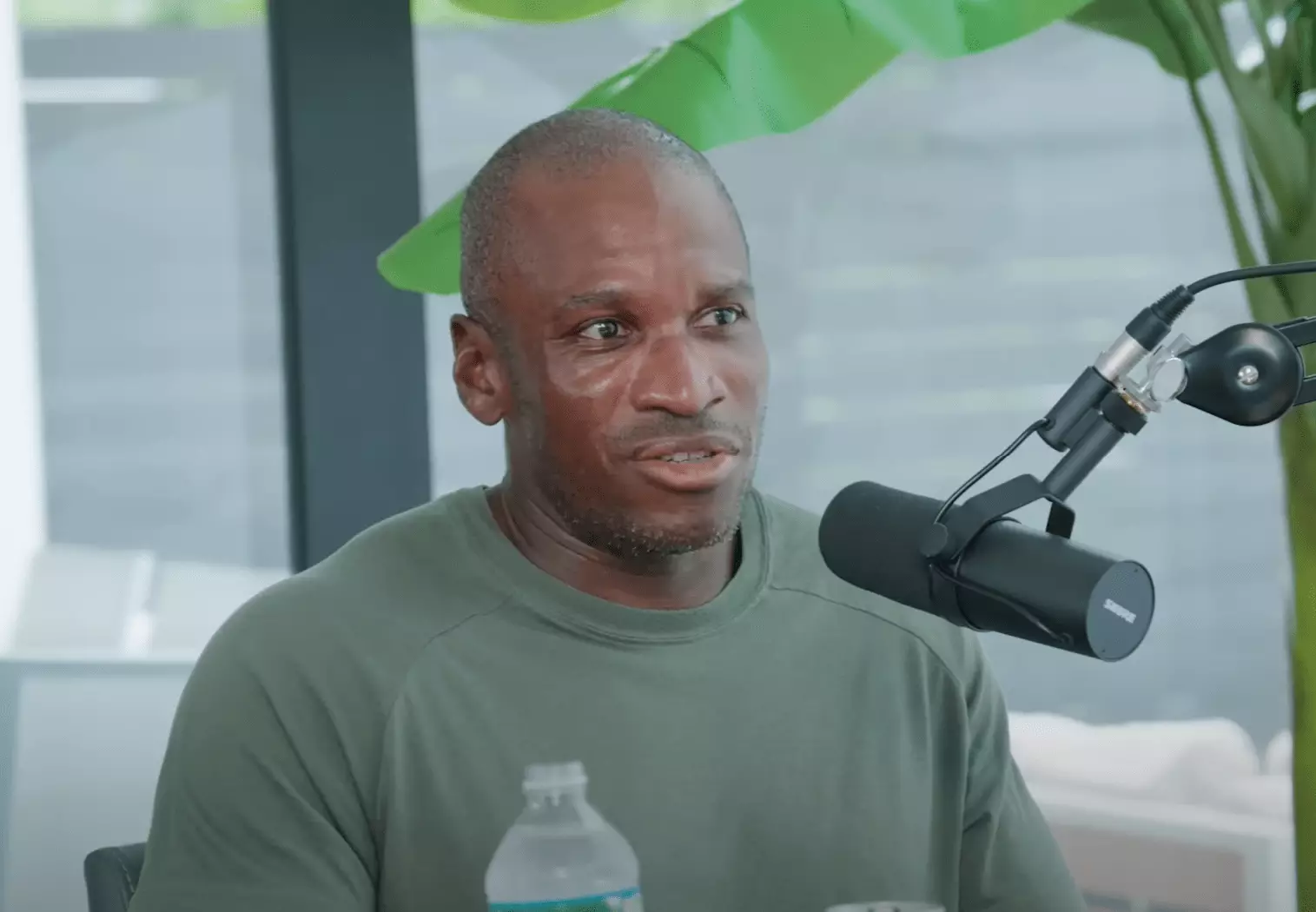

The cryptocurrency landscape is ever-changing, and recent observations from influential figures can provide new insights into its trajectory. Arthur Hayes, the Chief Investment Officer at Maelstrom and co-founder of the renowned trading platform BitMEX, has stirred discussions with his latest essay, “The Ugly.” In this piece, Hayes offers a candid reflection on the current landscape of Bitcoin, predicting a potential decline before an eventual surge to new heights. In this article, we will delve into Hayes’ perspectives, analyze the implications of his insights, and explore the broader consequences on the market.

In his writing, Hayes draws an analogy between financial markets and the unpredictable nature of backcountry skiing on a dormant volcano. This comparison resonates particularly well in today’s complex economic environment, where seemingly minor changes in monetary policy can have significant ramifications. The feelings of unease he expresses mirror concerns many investors have faced historically during turbulent times, particularly the alarming downturns observed in late 2021. Hayes describes an unsettling mix of market signals—central bank balance sheets, variations in banking credit, and the movements of U.S. treasury bonds—all of which contribute to an overwhelming sense of volatility and uncertainty.

In this atmosphere, Hayes sees potential trouble brewing for Bitcoin, speculating a drop to between $70,000 and $75,000—a level many had previously deemed unthinkable after Bitcoin achieved its record highs. The current “filthy fiat” environment, characterized by rising interest rates and lingering inflation, forms the backdrop against which he frames his outlook. This scenario begs the question: Are investors prepared to weather another storm that could shake the foundations of cryptocurrencies like Bitcoin?

One of the key takeaways from Hayes’ essay is his identification of two critical scenarios for Bitcoin trading. The first scenario outlines a strategic approach focusing on risk management. He posits that by maintaining a leaner position and increasing holdings in stablecoins like USDe, he can effectively position himself to repurchase at lower levels if the market faces a significant pullback. By doing so, investors can preserve capital while waiting for a favorable re-entry point in a redefined market landscape.

In the second scenario, Hayes highlights the necessity to adapt to market signals—particularly if Bitcoin surpasses the $110,000 mark with strong trading volume. In such an event, he suggests a willingness to reinvest and accept a higher risk profile. This dual-awareness of the market’s shifting dynamics can serve as a guiding principle for many traders, exemplifying the need to remain agile in an environment defined by rapid changes and unprecedented volatility.

Hayes’ analysis is also steeped in macroeconomic observations, particularly concerning the actions of major central banks like the Federal Reserve, the People’s Bank of China, and the Bank of Japan. His argument hinges on the belief that monetary policies are potentially stifling speculative capital, which has previously driven prices upwards. As interest rates rise and money creation is curtailed, the traditional drivers of asset price inflation, including Bitcoin, may come under pressure.

Furthermore, the political landscape plays a crucial role. Hayes scrutinizes the existing tensions between Donald Trump and the Federal Reserve, suggesting that such animosities could lead to scenarios where federal interventions become necessary to mitigate financial instability. This interplay of politics and economics is critical when assessing potential market outcomes, as the delicate balance between intervention and market freedom may sway investor sentiment dramatically.

Perhaps one of the most provocative points in Hayes’ essay is the recognition of Bitcoin’s correlation with traditional risk assets. Historically viewed as a distinct store of value, Bitcoin now exhibits noticeable movements alongside equities and other financial instruments. This observation raises important questions about Bitcoin’s status as a hedge against market downturns; while it has demonstrated resilience over the long term, its short-term sensitivity to liquidity fluctuations may challenge its position as a purely independent investment.

As bond yields rise and equity markets experience volatility, Hayes suggests that Bitcoin may decline ahead of tech stocks, a phenomenon that could redefine investment strategies among crypto advocates. With market behavior becoming increasingly intertwined, it appears that Bitcoin’s role as a leading indicator could complicate its narrative among seasoned investors.

Arthur Hayes brings a pragmatic approach to analyzing Bitcoin’s potential movements within the volatile tapestry of modern financial markets. His articulated risk management strategies and nuanced understanding of macroeconomic forces provide valuable context for investors aiming to navigate the complexities of cryptocurrency investing. The upcoming months may prove to be a testing ground for these strategies, as traders grapple with significant potential downturns and the ultimate quest for stability in this digital frontier. The balancing act between preparedness for risk and seizing lucrative opportunities will be crucial as the market continues to evolve in unforeseen ways.