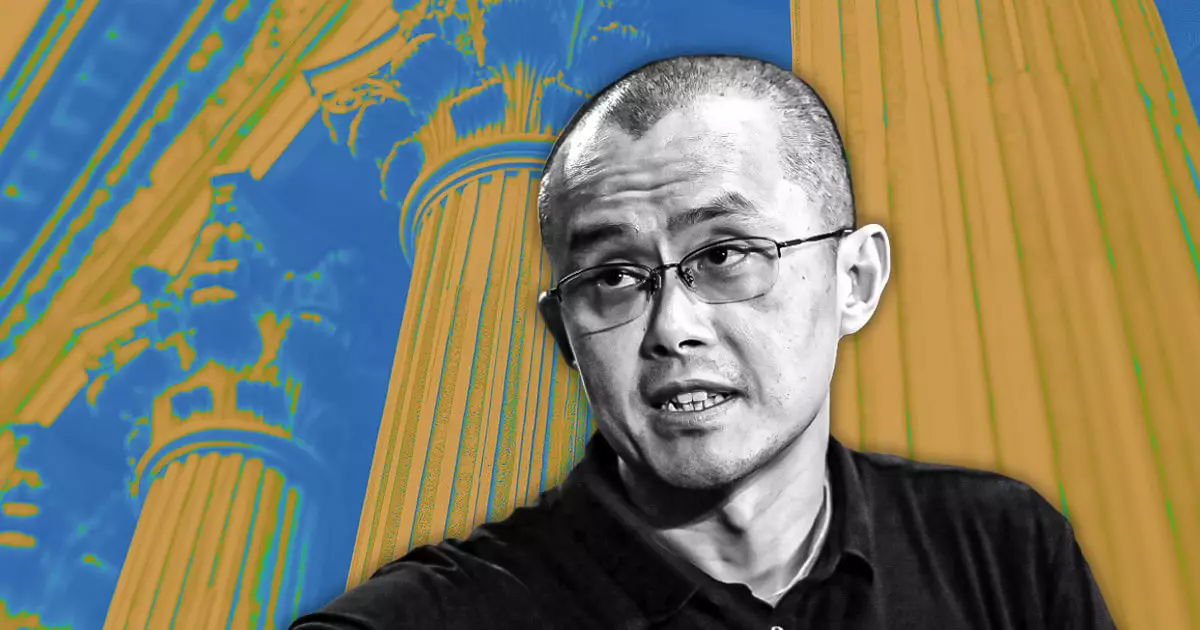

The landscape of cryptocurrency exchanges is as volatile as the digital currencies they handle. Recently, Changpeng Zhao, the founder and former CEO of Binance, had to clarify rumors surrounding the exchange’s ownership status. Following speculation that Binance was on the verge of being sold or seeking a significant buyer, Zhao took to social media on February 17, addressing the misconceptions directly. He dismissed the assertions as “misinformation” perpetrated by a “self-perceived competitor in Asia.”

Zhao’s comments signify a strong stance against unfounded claims that could potentially destabilize investor confidence in Binance, which continues to be a market leader even amidst swirling rumors. He affirmed that while a full sale is not on the table, there might be opportunities in the future for external investors to purchase minority stakes in the company.

Binance’s co-founder, Yi He, supported Zhao’s assertions, indicating that investor interest in the company has always been robust. As the company’s reputation grows, so too does the enticement for potential investment, although He confirmed that at this juncture, there are no intentions to dilute ownership structure. Nevertheless, Zhao mentioned that investments could be permitted in the “single-digit percentage range,” signaling a slight but symbolic shift toward opening up the company to outside financial stakeholders.

This potential for minority stake sales may reflect a strategic approach for Binance to bolster its financial standing while keeping operational independence intact. Should this transition take place, it might pave the way for institutional investors to gain insight into the workings of one of the leading crypto exchanges without fully controlling the company.

The rise of speculation came shortly after users observed notable decreases in Binance’s crypto holdings. Many in the community connected these movements to possible asset liquidations or a sign of financial distress. To counter these apprehensions, Binance explained that the changes were part of a normal treasury accounting adjustment process rather than a precursor to a sale or indication of instability.

Furthermore, a viral post on a popular Chinese social media platform further fueled the narrative that Binance was racing toward a sale due to regulatory hurdles and a pivot towards decentralized exchanges (DEXs). While this conjecture lacked a defined buyer, such rumors can significantly impact community trust and market perceptions.

Despite facing regulatory and legal challenges globally, Binance continues to maintain its position as the leading exchange by trading volume, facilitating billions in transactions daily. However, competition from both centralized and decentralized exchanges is intensifying, with many analysts proposing that Binance’s openness to minority stake investments could be a proactive move to stabilize its financial future while dodging any direct loss of control.

In essence, as Binance navigates through a turbulent environment marked by investor speculation and regulatory scrutiny, it is prudent for the company to explore innovative strategies to maintain its dominance in the ever-evolving crypto marketplace. The exploration of external investment opportunities could be a critical step toward reinforcing its market position without sacrificing the autonomy that has driven its success thus far.