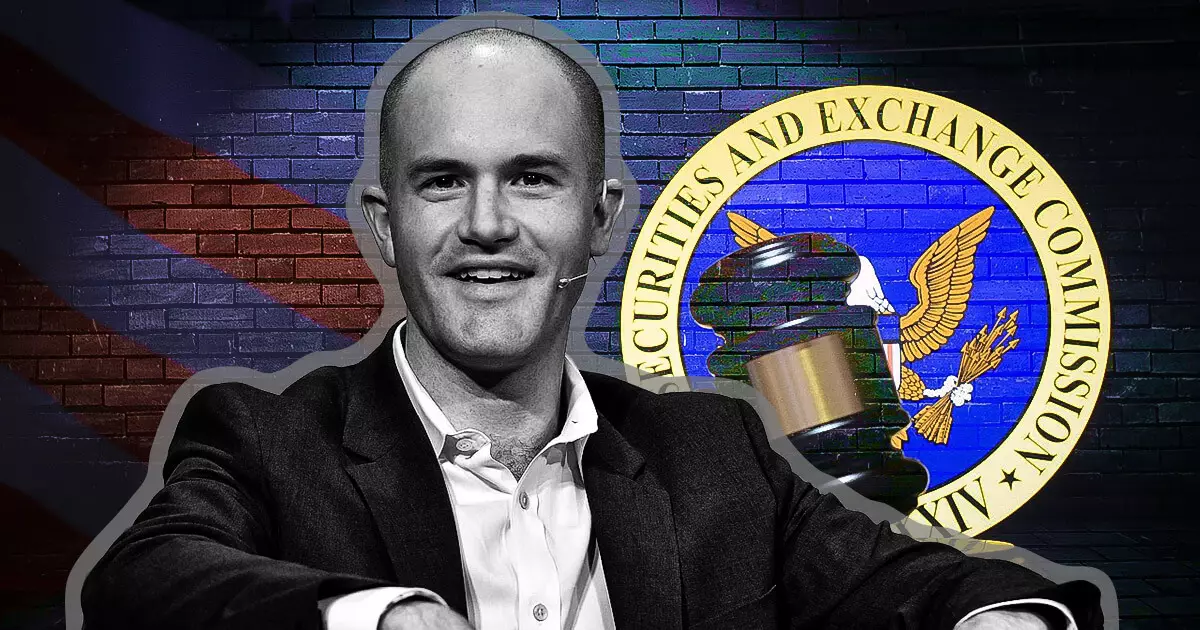

In a significant statement that has stirred conversations within the crypto community, Coinbase CEO Brian Armstrong declared a radical reorientation of the company’s legal strategies. On December 3, Armstrong took to social media to announce that Coinbase would be cutting ties with any law firms that engage former regulatory officials linked to what he termed “unlawful” actions against the crypto industry. This bold stance represents not only a departure from typical legal partnerships but also a critique of existing regulatory frameworks that are perceived as antagonistic toward cryptocurrency advancements.

Armstrong’s remarks notably targeted Milbank LLP, following the announcement that former SEC Division of Enforcement Director Gurbir S. Grewal had joined the firm. By pinpointing Milbank as a firm Coinbase would avoid, Armstrong arguably underscores a larger issue; the implications of regulatory officials transitioning to powerful positions within private law sectors. This move raises questions regarding conflicts of interest and highlights the tensions between regulatory actions and the operational needs of cryptocurrency firms.

The CEO claimed that Grewal’s actions during his tenure at the SEC contributed to what he described as an “ethics violation.” He criticized senior partners in law firms for misunderstanding the crypto industry’s landscape, suggesting that their disconnection from the realities of digital finance underscores the need for reform in both their understanding and policymaking processes.

Armstrong’s critique extends beyond personal attacks; he framed it within a larger narrative about regulatory accountability. His contention was that the previous SEC administration under Gary Gensler engaged in an unlawful campaign against cryptocurrencies by withholding clear compliance guidelines. In his perspective, this resulted in an opaque regulatory environment detrimental to innovation. Armstrong emphasized, “If you were a senior there, you cannot say you were just following orders,” pushing for a reevaluation of choices made by former SEC officials.

This notion of accountability isn’t merely focused on punitive measures; it reflects a more profound desire for transparency and well-defined regulations in the crypto sector. He argued that the industry should not support individuals whose actions are perceived to have harmed it financially or operationally, advising stakeholders to communicate this stance clearly.

Armstrong’s declaration signals a new chapter in the ongoing battle between cryptocurrency entities and regulators. Amid continued scrutiny and legislative challenges, this strategy taken by Coinbase reinforces the need for clear, constructive dialogue between the two parties. It also raises concerns about the future of regulatory relationships and the possibility of more robust protection for the burgeoning digital asset market.

As regulators and industry leaders navigate this complex relationship, Armstrong’s message resonates with many in the crypto community: unambiguous guidelines and fair treatment are fundamental for fostering innovation. The shift in Coinbase’s legal strategy may indicate a broader push for systemic change, potentially redefining how businesses interact with regulatory bodies in the digital finance sphere.