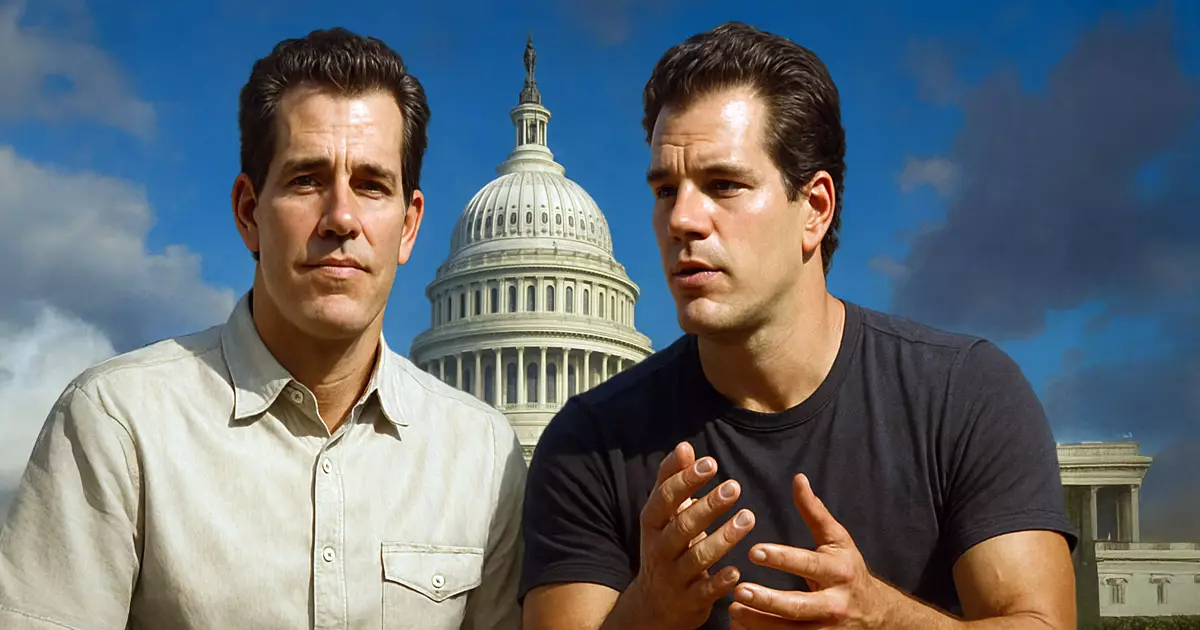

The recent surge of major crypto figures, notably the Winklevoss twins, creating substantial political influence through the Digital Freedom Fund PAC marks a pivotal moment in the nexus between digital currency innovation and American politics. With an eye on the upcoming 2026 midterms, the donation of over 188 Bitcoin—valued at $21 million—signals a deliberate move to shape policy and electoral outcomes favoring a pro-cryptocurrency agenda. This calculated endorsement raises pertinent questions about the influence of wealth and technology on democratic processes, as well as the potential consequences of privileging a specific ideological viewpoint rooted in libertarian-leaning principles.

The PAC’s mission extends beyond mere political causality; it aims to cement a pro-cryptocurrency environment that challenges existing financial regulations and government oversight. This effort is a nuanced form of activism, anchored in the belief that a hands-off regulatory approach will catalyze the so-called “American Golden Age,” driven by innovation, economic growth, and individual freedoms. While supporting candidates aligned with this vision might seem advantageous for fostering economic dynamism, it also unearths inherent risks tied to unchecked technological deregulation and the possibility of fostering a financial ecosystem far less accountable than traditional frameworks.

Legislative Strategies: Balancing Innovation and Risk

Central to the PAC’s agenda is the introduction of what Tyler Winklevoss calls a “Skinny Market Structure Bill”—a legislative proposal designed to facilitate innovation without succumbing to regulatory overreach. This proposed bill, emphasizing six core components, includes a “Bitcoin and Crypto Bill of Rights” that aims to enshrine ownership rights, self-custody, and peer-to-peer transactions as fundamental legal protections. Such measures could represent a turning point, effectively codifying individual sovereignty over digital assets and shielding developers from liability through protections akin to those granted by Section 230 of the Communications Decency Act.

However, this ambitious legislative vision warrants intensive scrutiny. While empowering users and developers aligns with libertarian ideals of minimal state interference, it also raises questions about how well these protections can prevent abuse and ensure market stability. Cultivating an environment where startups can flourish with minimal regulation is promising, but it risks neglecting the safeguards that prevent fraud, money laundering, or systemic shocks—especially given the volatile nature of digital assets.

The PAC also explicitly opposes CBDCs, framing these sovereign-backed digital currencies as “totalitarian technologies.” While this stance champions individual freedom and privacy, it could be seen as dismissive of the potential benefits of robust government-backed financial infrastructure designed to promote financial inclusion and stability. The tension between skepticism of central authority and the need for regulatory oversight remains at the core of this debate; whether the proposed measures strike the right balance is an open question.

Regulatory Philosophy and Economic Implications

Supporting agencies like the SEC and CFTC in advancing crypto initiatives shows the PAC’s commitment to working within existing regulatory structures—albeit with a push for reforms that favor innovation. Tyler Winklevoss’s enthusiasm for the “Project Crypto” and “Crypto Sprint” initiatives suggests a desire for rapid, yet responsible, regulatory evolution that minimizes burdens on startups while maintaining industry credibility.

However, the response to these initiatives often hinges on the perception that regulations are becoming vehicles for entrenched interests—regulatory capture—ultimately stifling genuine competition and innovation. Fluency in this landscape necessitates recognizing that regulatory clarity can indeed bolster industry growth, but unchecked deregulation risks catalyzing fraudulent schemes and market manipulation, which could tarnish the reputation of cryptocurrencies.

The emphasis on reducing startup costs—to the point of comparing them to registering companies in impoverished nations—grounds the PAC’s stance in a belief that financial barriers should not prevent innovation. While this sounds ideal, it invites skepticism about whether such leniency could open doors to illicit activities or destabilize the market through unregulated exploits. It underscores a philosophical commitment to access and opportunity, yet leaves unresolved the challenge of safeguarding consumers and investors in an ecosystem where regulatory oversight is intentionally light.

In essence, the PAC’s approach embodies a libertarian-tinged vision favoring minimal government intervention, emphasizing technological sovereignty, and championing free-market principles. While admirable from a perspective of individual liberty and entrepreneurial spirit, the broader implications for financial stability, consumer protection, and the rule of law remain contentious. Whether this push for deregulation truly creates a fertile ground for innovation or fosters a precarious financial wild west is a question that only time will answer.