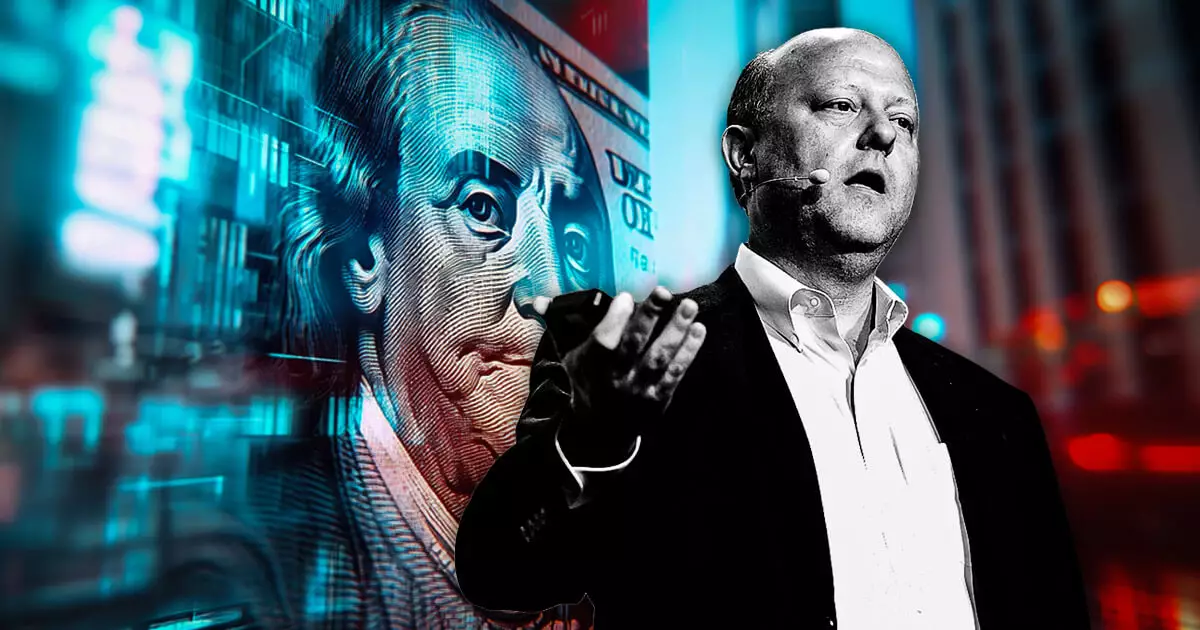

In an era where digital currencies are reshaping our financial landscape, the importance of establishing regulatory frameworks for stablecoins cannot be overstated. Jeremy Allaire, co-founder of Circle, recently highlighted the necessity for U.S. dollar-pegged stablecoin issuers to register within the United States. This call arises in response to an increasing urgency from lawmakers to provide oversight on digital assets during a Bloomberg interview dated February 26. The regulatory environment surrounding stablecoins is no longer an afterthought; it is a growing priority that has implications for both the financial industry and consumers.

Stablecoins have emerged as pivotal players in the cryptocurrency sphere, linking conventional finance with digital currencies. By pegging their value to stable assets such as the U.S. dollar, these tokens strive to minimize volatility, thus making them attractive for transactions and as a store of value. However, financial experts and regulators remain wary about the current state of stablecoins, primarily due to uncertainties regarding their reserve backing, consumer protections, and potential risks to the financial system. As the market for these digital assets expands, the patchy regulations governing these currencies must evolve to prevent potential instability.

Recent legislative initiatives underscore the shifting dialogue surrounding stablecoin regulation, notably with Senator Bill Hagerty’s (R-Tenn.) introduction of a bill designed to create a federal regulatory framework. This initiative is remarkable as it marks one of the first significant attempts at formal regulation under the current administration. The Trump administration’s openness to embracing cryptocurrencies as a national asset could pave the way for a more structured environment. Nevertheless, striking a balance between regulation and innovation remains a contentious debate among industry stakeholders.

While Allaire’s push for regulatory registration seeks to enhance trust and accountability, there are contrasting opinions among industry experts. Some caution that a rigid regulatory framework could stifle innovation, yielding negative consequences for competition on a global scale. As the digital assets market continues to grow, it is vital to ensure that regulatory measures do not serve as barriers to advancement. The key lies in creating a flexible yet robust framework that fosters innovation while safeguarding consumers and the economy.

The fate of stablecoins and their proposed regulatory landscape is poised at a critical juncture. As various stakeholders—policymakers, industry leaders, and consumers—navigate the complexities of digital finance, the outcomes of legislative measures like Hagerty’s bill could significantly influence the crypto ecosystem. With stablecoins now embedded in the fabric of cryptocurrency transactions, effective regulation could potentially enhance payment efficiency and stimulate further innovation.

The urgent call for registration and clear guidelines for stablecoin issuers reflects a broader industry movement aimed at instilling trust and stability within the market. As regulatory discussions gain momentum, it is essential for stakeholders to collaborate in shaping a future that nurtures innovation while ensuring consumer protection and financial stability. The ongoing debate is not merely about regulation; it encapsulates the future of digital finance in the United States.