The legal confrontation between the Securities and Exchange Commission (SEC) and Ripple Labs keeps evolving, and recent developments ensure that this saga is far from over. On October 2, 2024, the SEC filed an appeal against a federal court decision that had presented a mixed bag of results in its high-profile litigation against Ripple. This action arrives after a pivotal ruling in August, where the court had issued findings that Ripple executives had interpreted as a significant stride forward for the entire cryptocurrency industry.

The ongoing tensions were initially triggered when the SEC accused Ripple of executing a $1.3 billion unregistered securities offering through its XRP token sales back in December 2020. Despite the SEC’s allegations, the ruling by U.S. District Judge Analisa Torres provided a blend of outcomes. Notably, her decision indicated that XRP sales to retail investors via crypto exchanges did not fall under illegal securities activities. Conversely, the court concluded that Ripple’s direct sales to institutional investors were indeed unregistered securities transactions, leading to penalties amounting to $125 million for the company.

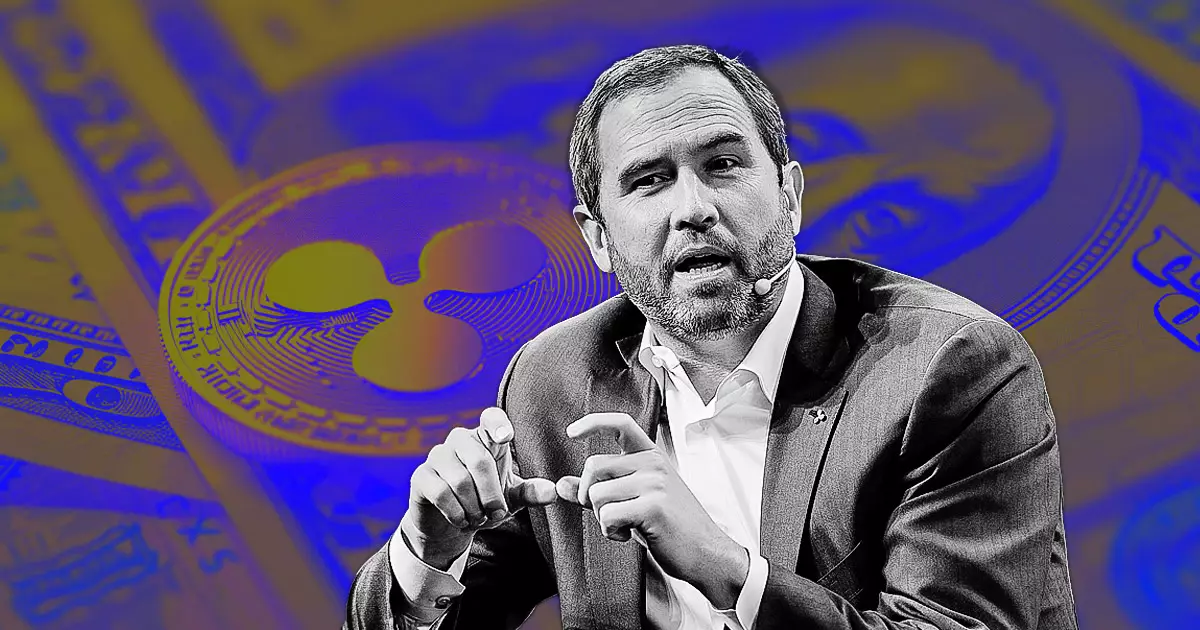

The Ripple CEO’s Response

Ripple’s leadership responded publicly to this new SEC appeal with frustration. CEO Brad Garlinghouse, along with Chief Legal Officer Stuart Alderoty, articulated their discontent regarding what they see as unnecessary legal posturing by the SEC, claiming that the regulatory body is squandering taxpayer resources on a matter they believe has already been favorably resolved for Ripple. Garlinghouse emphasized a critical point: the legal status of XRP remains that of a non-security, irrespective of the SEC’s appeal. This declaration echoes sentiments shared by advocates of the cryptocurrency community, who argue for clearer regulatory definitions.

Garlinghouse’s critique of the SEC was particularly pointed, noting that the agency appears to be engaged in a relentless legal struggle with little consideration for the consequences of their actions. He has suggested that the SEC has “lost on everything that matters” under current Chair Gary Gensler, highlighting the ongoing frustrations within the crypto ecosystem concerning regulatory clarity.

In light of the SEC’s announcement, XRP’s market performance has experienced notable volatility, with its value plummeting approximately 9% shortly after news of the appeal spread. As of early October 3, 2024, XRP was trading slightly above $0.54, a decline reflecting market apprehension surrounding the proceedings. XRP’s ranking within the cryptocurrency market fluctuated as well, indicating the tangible influence of regulatory actions on digital asset valuations.

Beyond Ripple and XRP, this case has significant ramifications for the entire cryptocurrency landscape. It highlights the broader struggle many digital currencies face in establishing a clear and stable regulatory environment. While parts of the ruling from August were seen as a victory, the unresolved matters now re-enter into active dispute, causing uncertainty and anxiety among investors and stakeholders. The overall crypto market, worth approximately $2.12 trillion, is sensitive to such developments, indicating how intertwined the fortunes of individual tokens are with overarching regulatory narratives.

With the SEC’s appeal looming large, it is unclear what the next steps will entail for Ripple and its defenders. The company’s legal team has indicated they may explore the option of filing a cross-appeal, signaling their readiness to engage Robustly in this ongoing legal battle. This potential move underscores the dynamic nature of the struggle as Ripple seeks to solidify its position amid contentious regulatory frameworks.

While some observers celebrate moments of legal progress in this intricate landscape, the SEC’s decision to appeal brings the ghosts of regulatory uncertainty back to the forefront. Ripple’s situation encapsulates a microcosm of the challenges faced by the cryptocurrency industry, bridging the gap between innovation and regulation. As the appeal process unfolds, it will be essential to observe how this will shape the future of Ripple, XRP, and broader industry standards moving forward.