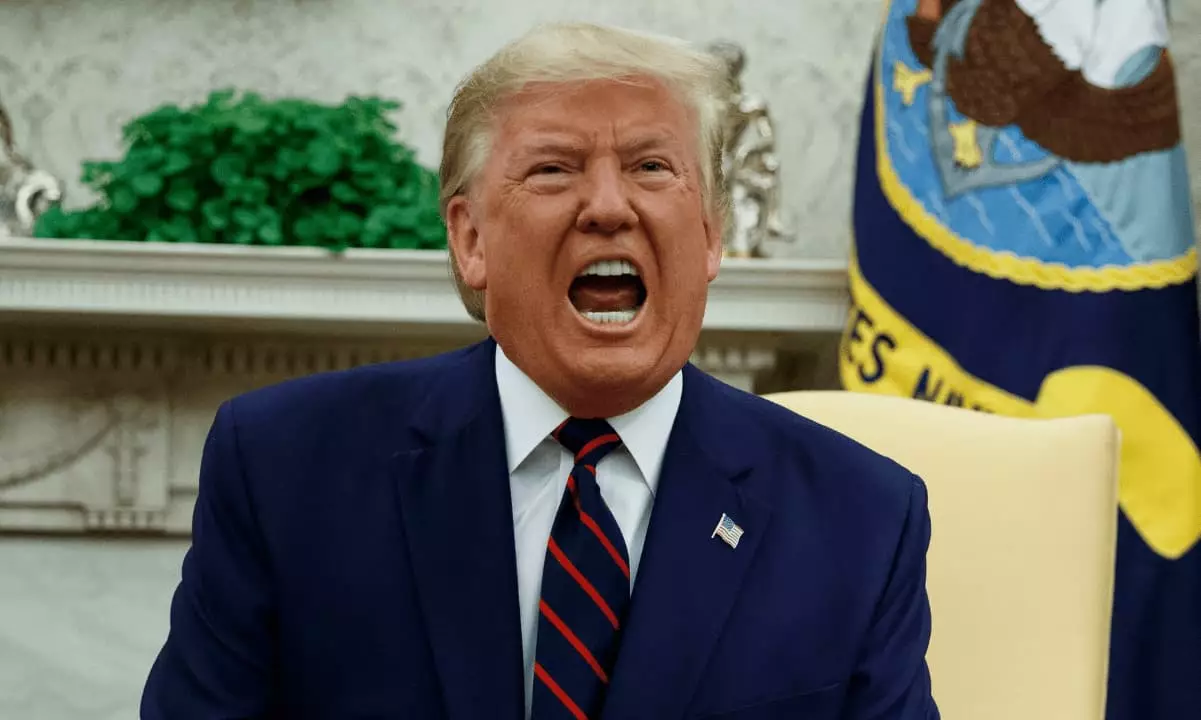

In the murky waters of political fundraising, the recent investigative inquiry into Donald Trump’s cryptocurrency ventures casts a long shadow. Top House Democrats, led by notable figures such as Gerald Connolly and Jamie Raskin, have raised red flags over potential legal violations, rampant foreign influence, and the eerie prospect of exploiting presidential power for personal gain. Stripped of all illusions, what emerges is a stark portrayal of a political environment increasingly tied to the wild and unpredictable world of cryptocurrency.

The inquiry targets several prominent players, including Trump’s most significant fundraising vehicle, WinRed, several political action committees, and intriguing ventures like the Trump family’s World Liberty Financial (WLF). By requesting suspicious activity reports (SARs), politicians are attempting not only to shine a light on financial irregularities but also to unveil the true extent of influence peddling in a potentially corrupt environment.

What we see is more than just a financial audit; it’s a reckoning with the complexities of mixing politics and crypto, where power meets profit in a recipe fraught with risk.

The Volatile World of Meme Coins and Political Action Committees

One of the scandalous undercurrents of this unfolding narrative includes the explosive rise of meme coins associated with Trump, namely TRUMP and MELANIA. These coins aren’t just digital novelties but active participants in a marketplace where the stakes are astonishing. The claim that entities tied to Trump control 80% of TRUMP’s supply and have accumulated over $100 million in trading fees raises eyebrows and questions of legitimacy.

Is there a hint of insider trading in the air? Certainly, many speculate on the involvement of foreign investors, rumored to be Chinese nationals, who are reaping profits while later entrants lose their shirts. The alleged pump-and-dump schemes naturally trigger memories of prior financial scandals but in the crypto realm, where anonymity reigns supreme, the dangers multiply. This high-risk venture into meme coins raises urgent national security concerns, calling into question how much influence non-U.S. citizens might wield over American policy—a slippery slope we’re all too familiar with.

The $75 Million Purchase: A Transaction Wrapped in Suspicion

Consider the hefty $75 million investment from Justin Sun, the founder of the Tron network, into World Liberty Financial’s WLFI token sale after WLF initially missed its fundraising targets. This transaction doesn’t just smell bad; it reeks of troubling associations and questionable timing in a landscape already riddled with scrutiny. With Sun under investigation by the SEC, the motivations behind such a financial maneuver must be questioned, particularly in light of allegations surrounding bribery and corruption.

Meanwhile, as foreign investors continue to flock to these dubious endeavors, the perception of American political figures seems increasingly stained. Cryptocurrency and political power are supposed to be mutually exclusive spheres, but this particular case showcases a convergence fraught with risk and denial. It beckons the question: Who is truly benefitting from these ventures?

A Reactionary Call for Regulation

As lawmakers pursue regulation, their resolve must be grounded in the reality that without stringent oversight, the field will attract more rogue investors and corrupt actors. The tide has shifted; the Democrats are now ramping up the pressure, actively voicing their concerns in the form of bills aimed at separating political figures from financial machinations tied to cryptocurrencies. Representatives like Ritchie Torres are advocating for bold action, including banning sitting presidents and members of Congress from monetizing digital currencies.

Contrast this with the recent failures in Congress to regulate stablecoins, epitomized by the defeat of the GENIUS Act. These instances illustrate a system struggling to keep pace with the rapidly evolving tech landscape—where power, greed, and technology intertwine to create a volatile brew incapable of safeguarding the public interest.

Only time will reveal the full consequences of this investigation. However, the observable trends highlight the unsettling and dangerous liaison between cryptocurrency and political fundraising. Through all these revelations, one truth emerges starkly: the wellbeing of American democracy stands on precarious ground as political ambitions converge dangerously with the untamed nature of digital currencies.