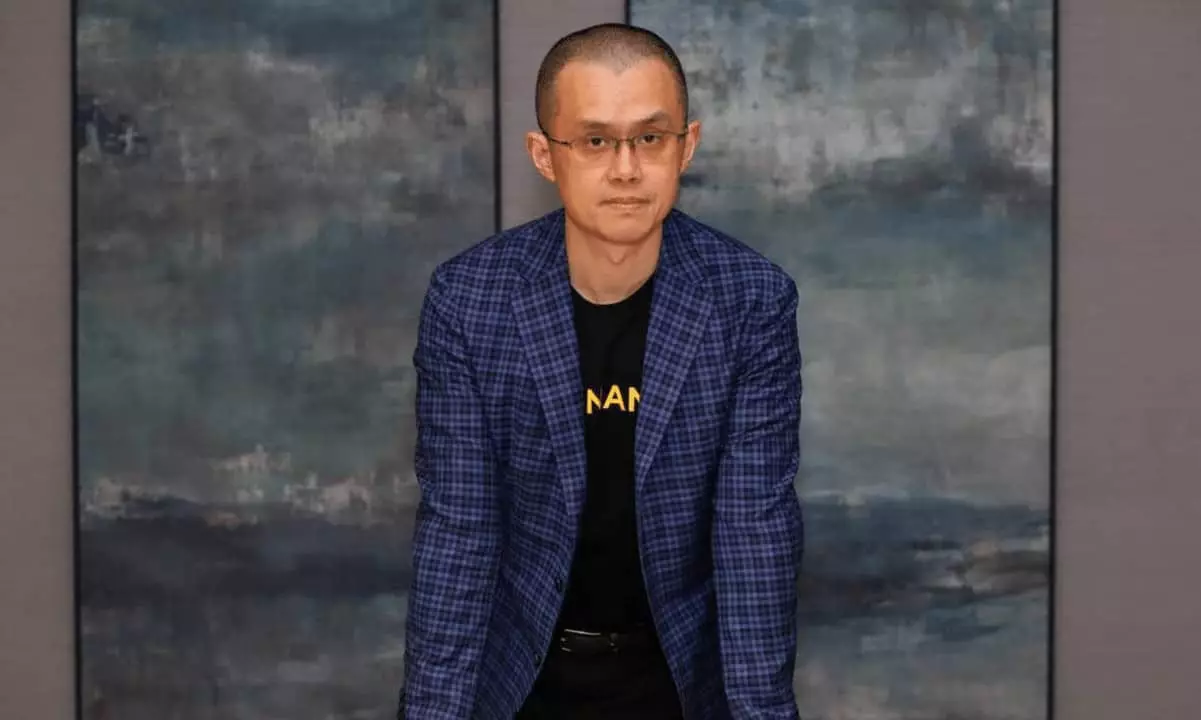

In a landscape often defined by volatility and rapid shifts, the endorsement from former Binance CEO Changpeng Zhao, commonly referred to as CZ, has made waves in the crypto space, significantly altering the fortunes of Travala’s AVA token. Following Zhao’s praises of the travel platform, AVA has seen a staggering increase of over 300% in a mere 24 hours. This surge highlights the influential role that key figures in the cryptocurrency market can play, especially when they champion promising projects.

The remarkable price increase is attributed not only to CZ’s endorsement but also to a series of strategic moves made by Travala. The company’s recent announcements reveal impressive milestones such as achieving $100 million in annual revenue, a notable rise from $59.6 million the previous year. This growth has coincided with ongoing innovation in the travel industry, as more consumers seek to use cryptocurrencies for booking flights and accommodations. Additionally, Travala’s strategic decision to allocate part of its treasury reserve in AVA and Bitcoin mirrors the investment approach popularized by notable figures like Michael Saylor and MicroStrategy. This strategic pivot has garnered attention, propelling investor interest and trust.

Zhao’s post on platforms like X has demonstrated the power of social media in driving market behavior. His shoutout to Travala, reflecting on Binance’s early investment during pre-pandemic times, has ignited enthusiasm within the crypto community. The post garnered over 1.3 million views, resulting in a surge in social media discussions surrounding AVA. This aligns with data from LunarCrush, which recorded a remarkable increase in AVA-related social activities in the wake of Zhao’s endorsement. The palpable excitement translated into an explosive 350% price rally, propelling AVA from $0.75 to a peak of $3.38.

As it stands, Travala’s AVA token has not only experienced a 310% upturn from its preceding price but has also demonstrated an astonishing 541% increase over the past month. With a trading volume exceeding $890 million during the 24-hour period analyzed, the token has surged far beyond the average performance of the broader crypto market, which has stagnated around a 2.20% decline over the same duration. This remarkable resilience amid market downturns underscores AVA’s unique positioning and potential as an investment.

Changpeng Zhao’s endorsement has markedly transformed Travala’s AVA token into a thriving asset, revealing the dynamic interplay between social media influence and market behavior in the cryptocurrency sector. As Travala continues to execute its innovative strategies and prioritize cryptocurrency integration for travel bookings, investor sentiment remains buoyed by the prospect of long-term growth. The trajectory of AVA serves as a compelling case study of how blockchain technology can revolutionize industries and, through strategic endorsements, significantly enhance market recognition. The events of the past few days suggest that Travala is well on its way to becoming a major player in the travel industry landscape, supported by the growing acceptance of cryptocurrency payment systems.