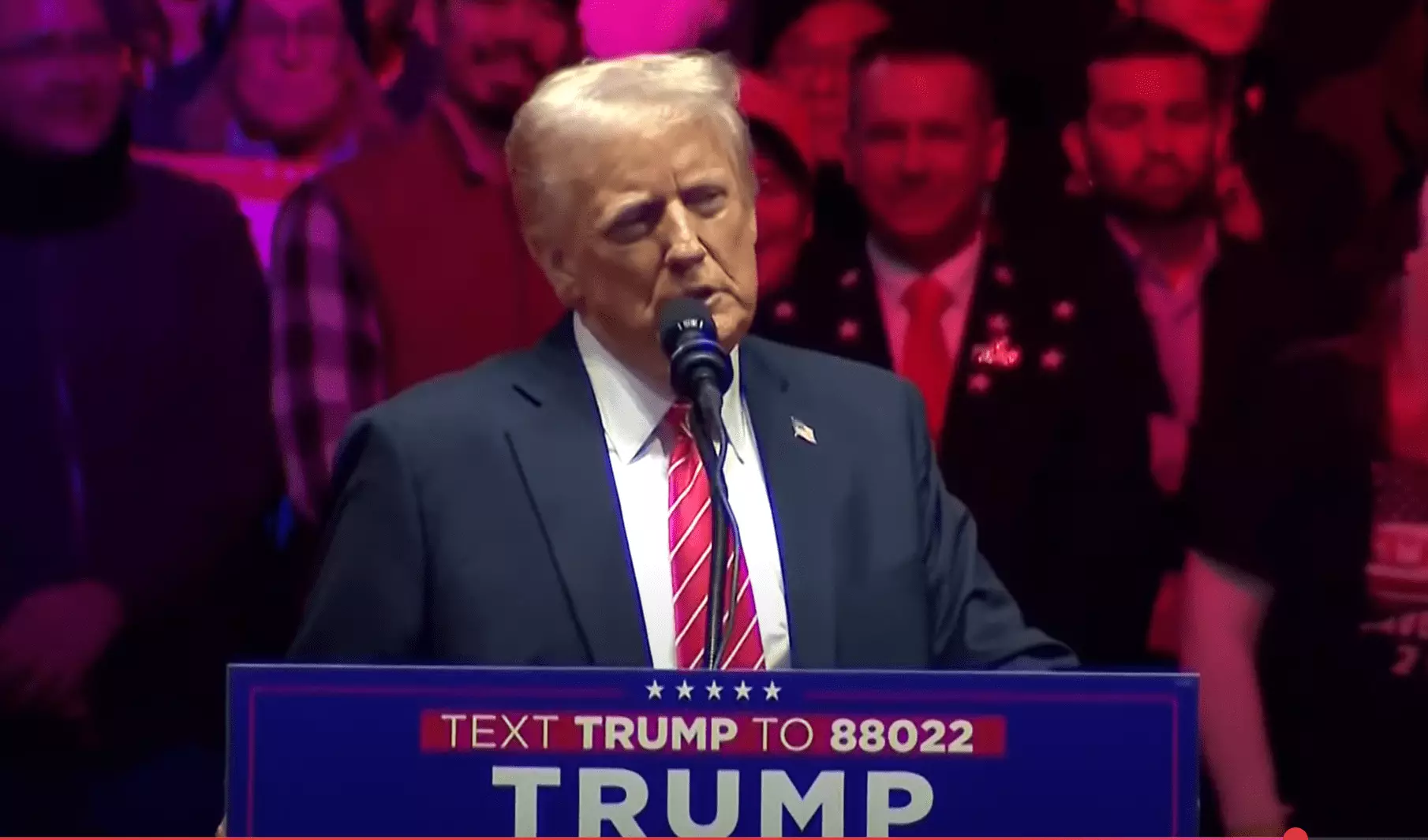

In recent days, Bitcoin has reached unprecedented heights, hitting an all-time high of $109,558, coinciding remarkably with Donald Trump’s inauguration. This unprecedented surge has sparked considerable interest and speculation within financial markets, particularly amid discussions surrounding potential government initiatives related to cryptocurrency.

The excitement surrounding Bitcoin’s price increase is closely tied to speculation about a possible executive order from Trump establishing a Strategic Bitcoin Reserve (SBR). Market observers have noted that discussions about such a reserve have been circulating for months, but the conversation has intensified notably as the inauguration day approached. A sudden spike in the probability of the establishment of this reserve was recorded on Polymarket, a crypto-based prediction platform, where the odds surged to 59%. This increase in odds appeared to be a precursor to the bullish trend in Bitcoin’s trading price.

Historically, Trump has expressed intentions to create a government-held reserve for cryptocurrencies, particularly Bitcoin, by transferring assets seized during law enforcement operations. While official announcements are still awaited, the prospect of such an order originating on Inauguration Day has contributed to the current bullish momentum in the market.

In the lead-up to the inauguration, several advocates for Bitcoin had significant engagements with the Trump administration, further fueling speculation about the potential for a government-backed Bitcoin initiative. Prominent figures, such as Senator Cynthia Lummis and Senator John Barrasso, were spotted discussing Bitcoin-related legislative efforts with the president. Their shared belief in the importance of digital assets illustrates the evolving dynamics of the cryptocurrency landscape in the U.S.

Senator Lummis, known for her enthusiastic support of Bitcoin, has made her intentions clear through social media. She emphasized her commitment to making the Strategic Bitcoin Reserve a reality, which could set the stage for substantial changes in how cryptocurrencies are viewed and managed at the government level. Furthermore, her proposed “Bitcoin Bill,” advocating for the acquisition of one million Bitcoin by the government, highlights the serious implications such actions could have on both market dynamics and regulatory frameworks.

MicroStrategy’s Chairman, Michael Saylor, was also seen interacting with notable figures within Trump’s circle, which solidified connections between the tech and cryptocurrency industries and the new administration. Through social media posts, Saylor showcased these meetings, signaling the optimistic outlook among Bitcoin advocates regarding the administration’s approach to cryptocurrency.

Moreover, Eric Trump’s social media activity, where he posted optimistic sentiments regarding Bitcoin, suggests that the incoming administration is gearing up to embrace cryptocurrency more visibly. The relationships being fostered between crypto advocates and political leaders indicate a possible shift towards more favorable regulations and an increased acknowledgment of the cryptocurrency’s potential.

Market analysts have started to interpret Bitcoin’s recent volatility as a potential indicator of future positive trends. Charles Edwards, CEO of Capriole Investments, noted that the quick price drop followed by an impressive rebound could signal robustness within the market’s framework. He emphasizes the notion that the second price movement in a fluctuating market often establishes a new trend.

Furthermore, the rapid transition of Bitcoin investors into a positive sentiment regarding a potential Bitcoin Strategic Reserve highlights a shift toward greater acceptance of cryptocurrencies amongst a broader audience. Edwards’ analysis suggests that as more institutional players enter this space, momentum could build, setting newer trends for Bitcoin.

Despite the triumphant optimism surrounding Bitcoin, it is crucial to recognize the volatility inherent in cryptocurrency markets. While many experts predict a bright future primarily due to anticipated government actions and increased institutional involvement, the cryptocurrency landscape remains fraught with uncertainties. Changes in regulatory frameworks, unexpected political decisions, or international economic phenomena can drastically alter the trajectory of Bitcoin in an instant.

As Bitcoin continues to redefine its position in the market and amid conversations about governmental legitimacy, the implications of Trump’s potential SBR could be extensive. This pivotal moment in cryptocurrency history provides a unique opportunity for Bitcoin to solidify its stance as a legitimate digital asset, albeit with challenges yet to be navigated. The next few months will undoubtedly be critical as the cryptocurrency landscape evolves in response to these discussions and potential legislative developments, marking a new chapter for Bitcoin and possibly reshaping the broader financial environment.