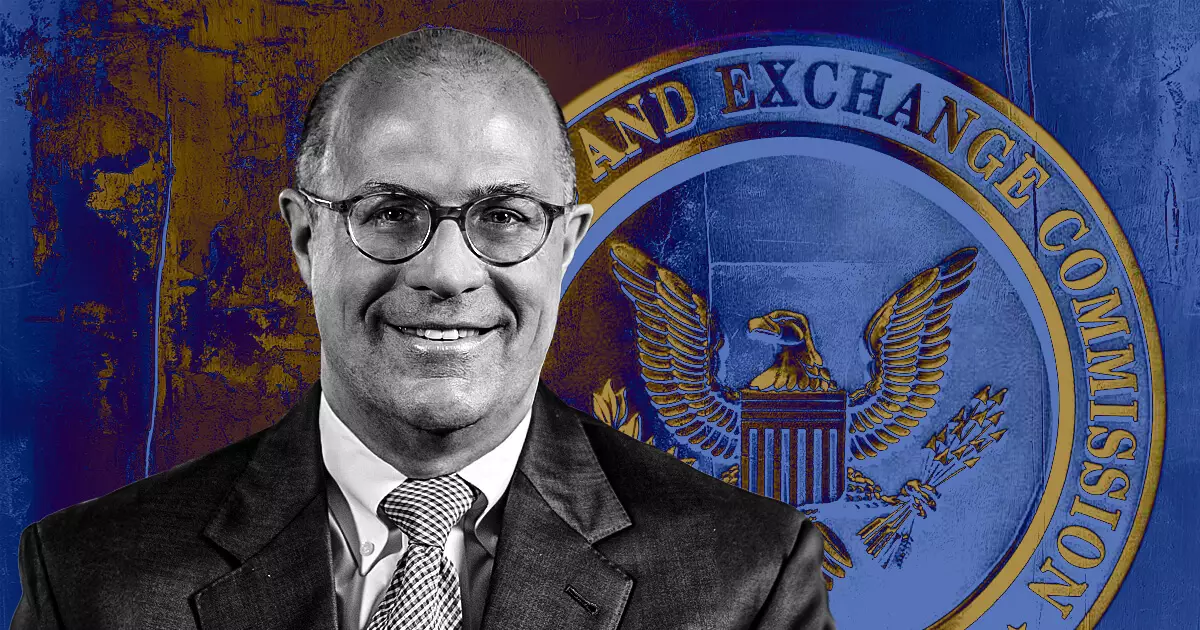

Former CFTC Chair Christopher Giancarlo has recently quashed speculation surrounding his potential appointment as the next Chair of the US Securities and Exchange Commission (SEC) or in any role within the US Treasury with a focus on cryptocurrency. Giancarlo, known as ‘Crypto Dad’ for his favorable perspective on digital currencies, firmly stated that he has no intention of revisiting the issues he previously tackled during his tenure at the CFTC. His comments suggest a clear desire to distance himself from the current regulatory tumult, implying that he has no interest in managing a situation he perceives as a chaotic aftermath left by SEC Chair Gary Gensler.

By referring to “the mess” he faced, Giancarlo likely alludes to the SEC’s controversial strategy of “regulation by enforcement,” which has drawn ire from various quarters for its supposed ineffectiveness. This term critiques the approach not only for its lack of proactive regulatory clarity but also for the subsequent implications this behavior has on the broader crypto landscape.

The Current Regulatory Landscape: Gensler’s Stance

In contrast, SEC Chair Gary Gensler has defended the Commission’s actions amid increasing scrutiny. Addressing the Practising Law Institute’s annual conference, Gensler made it evident that while Bitcoin may evade the classification of a security, a substantial portion of other cryptocurrencies do not enjoy the same exemption. By aligning many digital assets within the regulatory framework that governs traditional securities, Gensler seeks to strengthen investor protections and ensure market integrity.

Gensler cited vulnerabilities within the crypto market, stressing that insufficient oversight has led investors to face significant risks. His emphasis on the SEC’s role as a protective entity serves as a response to critics who argue that the SEC has not maintained a clear regulatory path for crypto firms. Instead, Gensler appears to promote a narrative centered on the necessity of stringent regulations to guard against the volatility and unpredictability quintessential to the cryptocurrency space.

Examining the Impact: Industry Concerns and Future Directions

The ongoing conflict between Giancarlo and Gensler underscores a deeper ideological divide in how to manage crypto regulations. Giancarlo’s more lenient approach could foster innovation and encourage growth within the industry, while Gensler advocates for a protective stance to shield investors, invoking compliance as a pathway to long-term sustainability.

Compounding the problem are numerous lawsuits that the SEC has initiated against various prominent crypto firms, sparking concerns from industry insiders about regulatory overreach. High-profile exchanges such as Kraken, Binance, Ripple, and Coinbase have all felt the effects of what many characterize as a heavy-handed approach by the SEC. Critics argue that this has cultivated an ambiguous environment where businesses struggle to thrive due to a lack of clear guidelines.

In navigating this complex regulatory framework, the ideal path forward remains under debate. There seems to be a pressing need for the SEC to strike a delicate balance between safeguarding investor interests and nurturing an innovative financial environment. As both Giancarlo and Gensler continue to shape the discourse surrounding cryptocurrency regulation, it is clear that their divergent perspectives will significantly impact the future of digital asset governance in the United States.