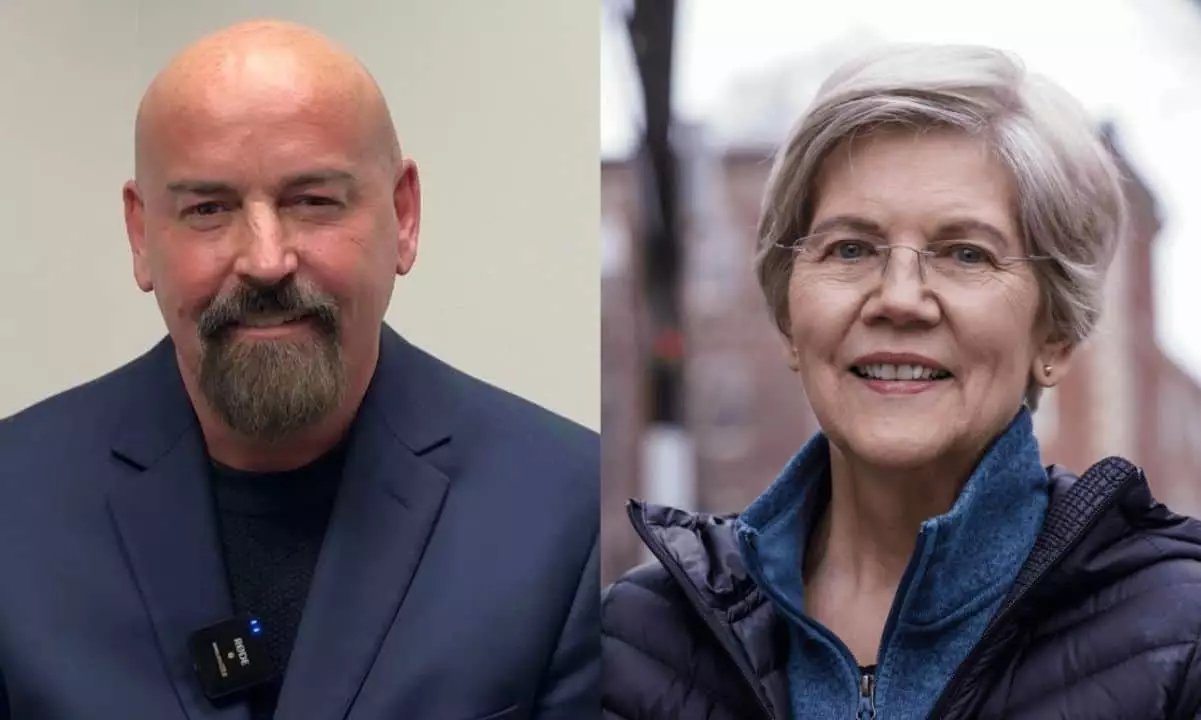

The recent debate between Massachusetts Senator Elizabeth Warren and her pro-cryptocurrency opponent, John Deaton, has ignited discussions about the future of digital assets in the United States. As two figures on opposite sides of the cryptocurrency spectrum, the clash revealed deep-seated ideological divides regarding financial autonomy, regulatory oversight, and the role of government in emerging markets. While Warren, known for her critical stance on cryptocurrencies, sought to accentuate the risks associated with these assets, Deaton countered with narratives emphasizing the potential for digital currencies to empower marginalized communities.

Senator Warren has long positioned herself as a formidable critic of the cryptocurrency sector, claiming that it poses significant threats to consumers and the overall stability of the financial system. Her argument centers around the notion that cryptocurrencies can facilitate illegal activities, including money laundering and financing terrorism. Warren’s apprehensions regarding unregulated digital assets are fueled partly by their perceived dangers to economic integrity and consumer safety. During the debate, she asserted, “I’m not against crypto, but it has to play by the same rules as banks and credit unions.” This statement reflects her desire for stringent regulatory frameworks that can help harness the potential of cryptocurrencies while safeguarding the interests of everyday Americans.

While her stance may resonate with traditional banking advocates, Warren has faced criticism for not addressing more immediately pressing issues such as inflation and skyrocketing living costs. Her focused attack on digital assets often leaves critics like Deaton perplexed. They argue that her efforts to tackle cryptocurrencies distract from the broader economic challenges affecting consumers.

John Deaton, an attorney and cryptocurrency advocate, asserts that digital assets can usher in financial inclusion for those abandoned by conventional banking systems. He argues for the vital role of cryptocurrencies in providing alternatives to predatory banking practices. During the debate, Deaton referenced his personal history, illustrating how cryptocurrency positively impacted his mother’s financial struggles with traditional banks rife with hidden fees. “I wish Senator Warren attacked inflation the way she attacks crypto,” he quipped, highlighting the disconnect between her fiscal focus and the realities faced by everyday citizens.

Moreover, Deaton has earned a reputation for his active participation in legal battles concerning cryptocurrency regulation. His role in the Ripple v. SEC case showcased a push against what he perceives as regulatory overreach. Through these efforts, he argues for greater rights and protections for individual cryptocurrency holders, contrasting sharply with Warren’s more cautious approach.

Central to the debate’s tension was the issue of campaign financing. Warren took aim at Deaton’s financial backing, suggesting that his ties to the cryptocurrency industry could influence his policy decisions should he be elected. “One candidate standing here is funded almost entirely by one industry—the crypto industry,” she stated. This accusation is indicative of broader concerns surrounding the nexus of money and politics, particularly in an industry as volatile and rapidly evolving as cryptocurrency. Critics argue that financial dependency on a single sector complicates one’s ability to prioritize constituents’ interests over industry profits.

Deaton, in an attempt to refute Warren’s claims, stated that she also has historical ties with corporate PACs, illustrating the pervasive nature of special interests in political campaigns. This discourse brings to light the complicated relationship between political figures and their funding sources, raising questions about authenticity in governance.

As the exchange progressed, the ideological chasm widened over consumer protections. While Deaton accused Warren of siding with established financial institutions that prioritize their interests over individuals, she maintained that consumer protections must be the priority. “Her policies benefit the financial elite, not the everyday person,” he asserted, indicating a belief that Warren’s approach may further entrench existing economic structures rather than empower ordinary citizens.

Ultimately, the debate between Warren and Deaton illustrates the monumental challenge of reconciling traditional financial systems with the disruptive potential of cryptocurrencies. As the digital asset landscape evolves, the conversations surrounding regulation, empowerment, and consumer rights will likely become increasingly prevalent in the political discourse. Both candidates must navigate this complex terrain deftly, or risk alienating constituents hungry for real solutions to real economic dilemmas.