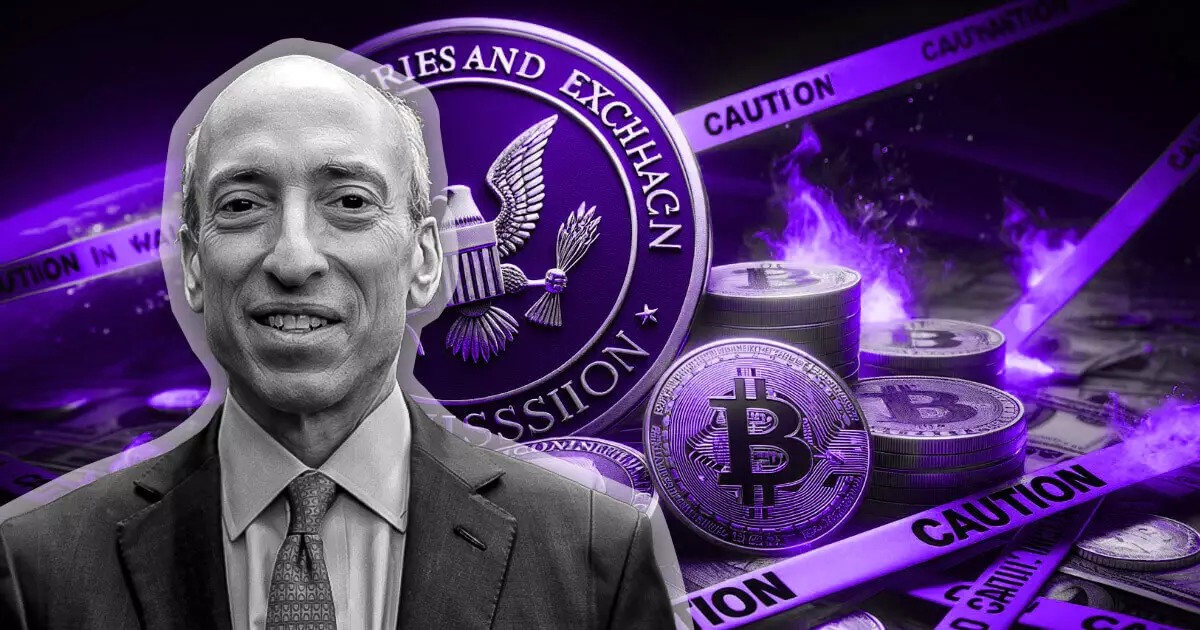

In a recent statement, Gary Gensler, Chair of the US Securities and Exchange Commission (SEC), provided crucial insight into Bitcoin’s regulatory status, asserting that it is not classified as a security. This declaration, made during an interview on CNBC’s Squawk Box on September 26, echoes sentiments expressed by his predecessors and emphasizes that Bitcoin continues to be regarded as a commodity under U.S. law. This classification marks a significant moment for the cryptocurrency market, particularly as the SEC has greenlit several spot Bitcoin exchange-traded funds (ETFs), an indication of the asset’s acceptance within traditional financial markets. By validating Bitcoin’s status, Gensler has taken a step towards providing clarity in a complex regulatory environment, which is vital for market participants and investors alike.

While Gensler has sought to clarify Bitcoin’s status, he has also expressed concern regarding the broader cryptocurrency sector’s compliance with existing regulations. He highlighted that many entities operating within the crypto space appear to disregard established rules, seeking questionable exemptions rather than adhering to regulatory guidelines. This non-compliance could pose risks not only to investor safety but also to the market’s overall stability. Gensler’s statements resonate with an ongoing theme in the regulatory discourse: the need for increased adherence to guidelines designed to protect investors. As the SEC navigates this complex terrain, the call for discipline within the crypto market grows louder.

In stark contrast to Bitcoin’s clear classification, Ethereum exists in a realm of regulatory uncertainty. Despite its immense popularity and integral role within the crypto ecosystem, the SEC has yet to declare whether Ethereum is a security or a non-security. This ambiguity creates significant challenges for projects built on Ethereum’s platform, leaving them vulnerable to regulatory scrutiny. Furthermore, while the SEC has approved Ethereum-based ETFs, it continues to investigate various entities connected to the Ethereum network, further complicating the landscape for developers and investors. This dual approach reflects a delicate balancing act: fostering innovation while still enforcing the law.

Gensler’s regulatory actions, particularly concerning Ethereum, have not gone unnoticed within the political sphere. Many members of Congress have criticized the SEC for its lack of clarity and consistency in regulating cryptocurrencies. Lawmakers have pointed out that terminology used by the agency, such as “crypto asset security,” has only served to sow confusion rather than provide necessary guidance for market participants. Critiques from other SEC Commissioners, like Hester Peirce, emphasize the agency’s failure to leverage its existing regulatory framework to instill trust and clarity in the market.

Despite facing criticism from various corners, Gensler remains steadfast in his belief that the future of the cryptocurrency industry hinges on developing robust regulatory frameworks. He argues that investor trust is crucial for the market’s longevity, suggesting that regulations act as essential infrastructure akin to traffic signals, guiding participants towards safer transactions. The contrasting regulatory approaches to Bitcoin and Ethereum illustrate the complexities of the crypto ecosystem, emphasizing the delicate balance between innovation, compliance, and investor protection as the SEC continues to navigate this rapidly evolving landscape. As the dialogue on cryptocurrency regulation progresses, achieving a consensus will be vital for the industry’s future viability.