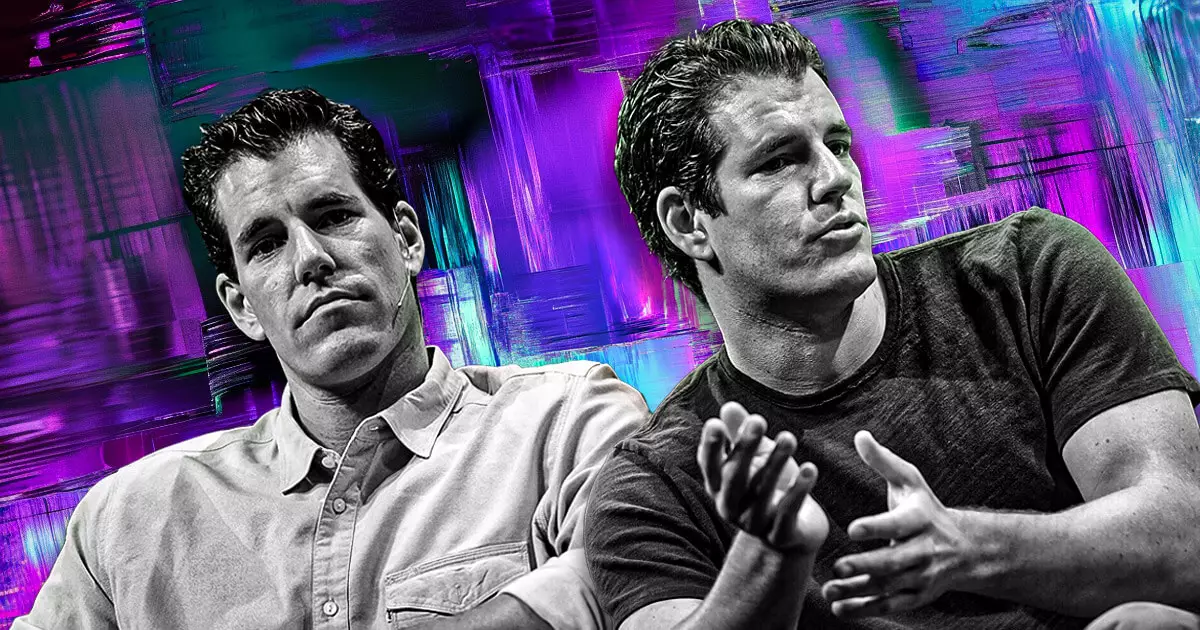

The cryptocurrency exchange Gemini is reportedly contemplating an initial public offering (IPO) that could occur within this year, according to insights from Bloomberg News. While specific details remain under wraps, the Winklevoss twins, Cameron and Tyler, who established Gemini, are evaluating potential advisers for this significant move into the public market. The exact timing and structure of the IPO, however, have yet to be finalized, indicating that the exchange is still in the preliminary stages of its public listing exploration.

The buzz surrounding Gemini’s IPO is indicative of a broader trend within the cryptocurrency sector. Industry analysts, such as James Seyffart from Bloomberg, anticipate an uptick in IPO pursuits among crypto firms over the coming years. This shift correlates with a perceived pro-crypto environment fostered during the Trump administration, which may encourage firms to seek additional capital through public listings. Coinciding with this trend, the Winklevoss twins’ recent donations of Bitcoin to Trump’s campaign—although partly returned due to exceeding the contribution limits—highlight the intertwining of finance and politics in advancing the crypto agenda.

Gemini’s decision to explore an IPO comes on the heels of significant regulatory hurdles that the company has faced. Earlier this year, the exchange agreed to a $5 million settlement with the Commodity Futures Trading Commission (CFTC) after being accused of misleading regulators concerning its Bitcoin futures offerings. Such regulatory scrutiny has spurred the company to strategically reassess its operations. Additionally, Gemini’s choice to exit the Canadian market—a move mirrored by other exchanges facing similar regulatory pressures—illustrates the complicated environment in which these firms operate.

Despite its difficulties in Canada, Gemini continues to adapt and explores opportunities in more favorable regulatory environments. Recently, Gemini secured a license in Singapore to provide cross-border money transfers and digital payment token services. This development highlights Singapore’s increasingly pro-crypto stance and positions Gemini alongside other crypto entities like OKX, Upbit, Ripple, and Coinbase, all of which have expanded their businesses in Singapore amid tightening regulations elsewhere.

As companies like Bullish Global—fortified by billionaire investor Peter Thiel—consider their IPO options, the landscape for cryptocurrency firms appears ripe for transformation. The movement towards public listings could catalyze a new era for the crypto market, enhancing transparency and mainstream legitimacy, albeit coupled with the challenges of ongoing regulatory scrutiny. The anticipated IPO of Gemini, coupled with the actions of other digital asset firms, may set important precedents that shape the future of cryptocurrency investment and regulation.

As Gemini contemplates a pivotal IPO amidst a backdrop of evolving regulatory frameworks and market strategies, the trajectory of the cryptocurrency sector remains uncertain yet promising. The outcomes of such moves will likely influence the industry’s growth and public perception, perhaps establishing new norms for how cryptocurrency operations are conducted in the future.